[ad_1]

It’s hard to believe that we’re in the last quarter of the year! With the year coming to an end, now is a great time to make some easy and smart tax moves to help lower your tax bill and increase your tax refund when you file.

Start compiling all of your receipts for any tax-deductible expenses and sources of income because these 10 quick and easy tax tips will help you get your finances organized and save money at tax time before the year ends!

1. Defer bonuses: If your hard work paid off and you are expecting a year-end bonus, this extra money in your pocket may bump you up to another tax bracket and increase the taxes you owe. If your bonus bumps you up to another tax bracket, you may want to consider delaying the extra income until the beginning of next year. If your boss is able to pay you your bonus in January, you will still receive it close to year-end, but you won’t have to pay taxes on it when filing your taxes.

2. Accelerate deductions & defer income: There are a handful of tax deductions that are recognized the year you pay them. For example, if you own a home, you can deduct your mortgage interest paid, and if you make an extra mortgage payment on December 31, you may be able to claim the additional interest paid as a tax deduction in the tax year paid.

This lets you take the tax deduction immediately rather than wait an additional 12 months when you do your taxes for next year. Before using this strategy, be aware that under tax reform, if you purchased a new home after December 15, 2017, you can deduct the mortgage interest you paid based on a home loan up to $750,000 instead of $1,000,000 for homeowners who purchased before that date.

3. Donate to charity: The holiday season is coming, which is a great time to clean out your closet and household goods for those in need. You can help someone in need and reap the benefits of a tax deduction for non-cash and monetary donations given to a qualified charitable organization if you can itemize your tax deductions.

If you volunteer at a qualified charitable organization, don’t forget that you can also deduct your mileage (14 cents of every mile) driven for charitable service. Make these donations count on your taxes by donating by December 31st. Even if you make a donation via credit card by December 31, you do not have to pay it off until the new year to receive the tax deduction.

4. Take a class: Taking a course to advance your career or improve skills is also a great way to lower your taxes and boost your tax refund. Paying for next quarter’s tuition by December 31 may give you a valuable tax credit up to $2,000 per tax return with the Lifetime Learning Credit.

5. Maximize your retirement: Another great way to reduce your taxable income while building your nest egg is to make a contribution to your retirement savings account. Whether you contribute to a 401(k) or a Traditional IRA, you can reduce your taxable income and also save for the future. If you are self-employed and contribute to a SEP IRA, you can contribute up to the lesser of 25% of your net self-employment income or $66,000 for 2023 ($73,500 if you are 50 and older). You can make a 2023 SEP IRA contribution up until the extended tax deadline for 2023 and possibly take a deduction for your contribution.

6. Spend your FSA: If you have a Flexible Spending Account and have money left, get caught up on your doctor visits. While the old “use it or lose it” rule may not still apply, you may only be able to carry over $610 worth of unused money left in your 2023 FSA account at the end of the year. Your plan may also limit the amount of time you’re able to use your funds to 2 1/2 months after the end of the plan year.

7. Buy Low, Sell Low: If you have a few investments in your portfolio that have gone down in value, did you know you can recognize your losses and use them to offset investment winners? To do this, you need to sell the losing investments and offset your losses against your gains recognized. If your losses exceed your gains, you can apply $3,000 of that loss against your regular income. Any extra will then be passed to the next tax year.

8. Make W-4 Withholding Allowance Adjustments: If you did not have the tax outcome you were expecting when you filed the previous year’s taxes or experienced life changes like having a baby, getting a pay increase or decrease, unemployment, or a new job, now is a good time to adjust the amount of taxes withheld from your paycheck by adjusting your withholding on your W-4 and refiling the form with your employer. TurboTax W-4 withholding calculator can help you easily adjust your withholding, whether you want a bigger tax refund or more money in your paycheck.

9. Be Aware of the Other Dependent Credit (ODC): Do you support your parents or grandparents? How about another loved one? If that happens to be you and they qualify as a non-child dependent, then make sure to take advantage of the new “Other Dependent Credit” worth up to $500, which can reduce the taxes you owe dollar-for-dollar by $500.

10. Go Green and Save Money on Your Taxes: Have you been looking into how to save money on your home energy bill or on gas? Go green and take advantage of the energy-efficient credits or the electric vehicle credit before the end of the year and save money on your taxes. Remember, credits are a dollar-for-dollar reduction of your taxes.

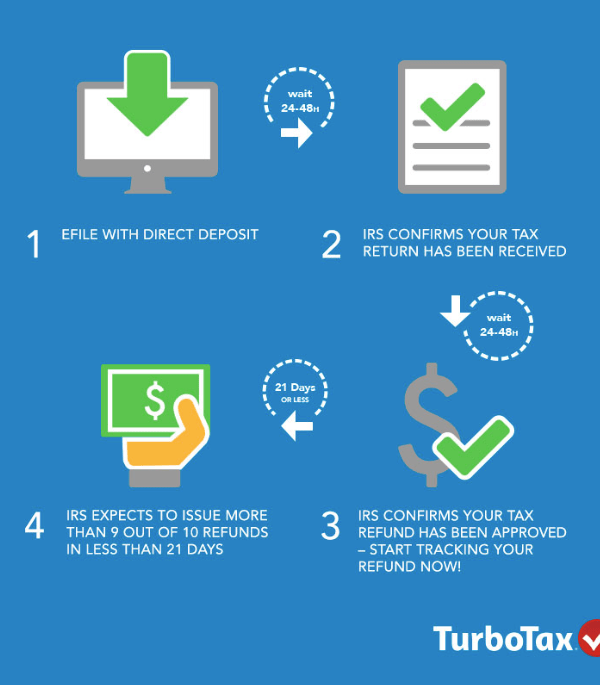

Don’t worry about knowing these tax rules. Meet with a TurboTax Full Service expert who can prepare, sign and file your taxes, so you can be 100% confident your taxes are done right. Start TurboTax Live Full Service today, in English or Spanish, and get your taxes done and off your mind.

56 responses to “10 End of Year Tax Tips to Increase Your Tax Refund”

[ad_2]

Source link