[ad_1]

When it comes to doing your taxes, it’s natural to feel stressed out. Although most people can breathe a sigh of relief after filing their annual returns, tens of millions of taxpayers face a variety of tax problems that extend the stress every year.

We go over the top tax problems Americans face today to help you prepare for whatever may come your way. Learn what each problem is and how to solve them with our helpful tax tips.

Hoping to avoid these tax issues altogether? TurboTax helps you accurately report your income, claim deductions, and credits so that you can feel confident about filing.

Top Tax Issues Taxpayers Face Today

After digging into the most recent data from the IRS, we’ve compiled the most prevalent tax problems affecting taxpayers today.

Note: All statistics in this post are from the IRS Data Book, unless another source is listed.

1. Tax Penalties

When you fail to comply with the tax code, you’re subject to IRS penalties. Penalties exist for not following filing, reporting, or payment requirements outlined by the IRS. The typical consequence for tax code mistakes is a civil penalty. And though it is not common, criminal prosecution is also possible depending on the circumstances.

In 2021, the IRS assessed nearly 41 million civil penalties amounting to $37 billion in taxpayer dollars. About 82% of these penalties came from individual and estate and trust tax returns. Of the individual and estate and trust penalties, the two most common were for failing to pay (51%) and estimated tax penalties for self-employed individuals (33%).

Examples:

- Failure to pay penalty

- Estimated tax penalty

- Failure to file penalty

- Bad check penalty

How to fix it:

If you receive a notice of a tax penalty from the IRS, you should comply with all instructions. You’ll want to read through the letter to verify that the information is correct and make sure to respond by the specified date.

For example, if you received a penalty for tax non-payment, you can either pay what you owe or request a penalty waiver. If you’re requesting penalty relief, make sure you gather the necessary documentation to support your claim.

2. Unpaid Taxes

Millions of taxpayers filed their tax returns, owed additional taxes, and didn’t pay by the deadline. When you have unpaid taxes, you’re hit with a 0.5% penalty for every month the amount isn’t paid in full. On top of this, the IRS will charge interest on the balance you owe.

Recent data from the IRS shows taxpayers owe more than $120 billion in assessed taxes, penalties, and interest from over 9 million delinquent accounts. If you’re in this situation, find out about your options for resolving this issue below.

Recently, the IRS announced that it was granting relief for nearly 5 million tax returns for 2020-2021 to help those who owe back taxes.

How to fix it:

The best course of action to resolve unpaid taxes is to pay the full amount to the IRS as soon as possible. Doing so will mean that you owe less in added penalties and interest over the long term.

Not everyone can pay in full right away, so check out these other options for solving unpaid taxes.

3. Math Error Notices

There are a number of reasons why people find doing their taxes stressful and crunching the numbers is one of them. Last year, the IRS sent math error notices to millions of taxpayers for mistakes like computational errors, incorrect values, missing entries, and failing to meet eligibility requirements. TurboTax takes the guesswork out of taxes, just answer simple questions and upload your documents or meet with an expert to avoid errors.

When it comes to math errors, the IRS has more freedom to go ahead and correct your mistakes without you having to adjust anything. Read the section below to see what you need to do if you get a math error notice in the mail.

How to fix it:

When you receive a math error notice, read it carefully. Depending on which notice you received, you may owe taxes, have your refund adjusted, or your tax balance may be zero (i.e., you don’t owe anything but also don’t get a refund).

You need to respond to the notice within 60 days of receiving it. If you owe taxes, you should pay them by the deadline. If you don’t owe anything, you still need to respond, but you won’t need to pay.

4. Non-Filers

Every year, millions of individuals and businesses fail to file their required tax returns by the tax deadline. The IRS uses third-party information returns (e.g., W2s or 1099s) to identify non-filers, create substitute tax returns, and assess what taxes, penalties, and interest are owed.

How to fix it:

If you miss the regular or extended tax deadline, you should file your taxes as soon as possible. Then it’s crucial to pay any taxes owed in full, as soon as you can. You’ll be charged a failure to file penalty of 5% on any outstanding taxes for each month you’re late, in addition to interest.

If you have yet to file but don’t owe taxes (i.e, you expect a refund), you won’t be charged any penalties or interest.

5. Tax-Related Identity Theft

Tax-related identity theft happens when someone steals your personal information (e.g., your Social Security number) to file a tax return and fraudulently claim a tax refund. Millions of Americans are suspected to be or are victims of tax-related identity theft every year.

In 2021, the IRS issued nearly five million Identity Protection Personal Identification Numbers (IP PIN) to taxpayers dealing with identity theft. IP PINs help verify your identity with the IRS so that you can file your return.

How to fix it:

It’s important to still file your taxes on time, even if you’re the victim of tax-related identity theft. You should receive a CP01A Notice containing your IP PIN, and you can use it to file your taxes. If you need an IP PIN, use the IRS’s Get an IP PIN tool to obtain one.

Remember to respond immediately to any notices from the IRS, and don’t forget to go to IdentityTheft.gov to learn what steps you should take to protect your other financial information as a victim of identity theft.

6. Underreported Income

When an individual’s tax return doesn’t match third-party information returns, this is considered underreported income. Underreported income is the leading contributor to America’s tax gap, which is the difference between the amount of taxes owed to the government and the amount that is actually paid voluntarily and on time.

Not only is the tax gap a large amount of lost revenue, but the IRS must also spend time and resources on resolving income discrepancies. In 2021, over two million cases were closed under the IRS’s Automated Underreporter Program, but it’s still estimated that $600 billion is lost annually.

How to fix it:

If you’ve received a Notice of Underreported Income (Notice CP2000), you should review the information carefully before deciding how to respond. If you agree with the proposed changes, mark this in your response and send it out on time. You’ll need to pay any outstanding taxes, penalties, and interest.

Even if you disagree with the notice, you should still respond on time and provide an explanation of why you disagree and any supporting documents. From there, you’ll work with the IRS to resolve any discrepancies.

7. Tax Audits

A recent tax refund stress survey found that a quarter of American taxpayers are worried that a mistake on their annual tax return will cause them to get audited by the IRS. In reality, much fewer people are actually audited. In fact, less than one percent (~739,000 taxpayers) were audited in 2021.

Although tax audits sound scary, they’re really just an examination of your tax return. The IRS checks your return to make sure that the information you report is verified and accurate. Learn about what to do in case the IRS audits your tax return below.

How to fix it:

First, read through your letter to see what information the IRS is requesting from you. Next, you’ll need to gather your requested documents and send them to the IRS for verification. Make sure you respond in a timely manner and don’t miss the deadline specified in your letter.

Audits conclude in one of three ways: no change, agreed, or disagreed.

- No change means that your information is verified and no changes are needed.

- Agreed means that you understand and accept the IRS’s proposed changes.

- Disagreed means you understand but don’t accept their proposed changes, and will undergo further review.

Don’t forget that you can contact TurboTax Audit Support for help if you’re ever unsure of what to do with a tax audit.

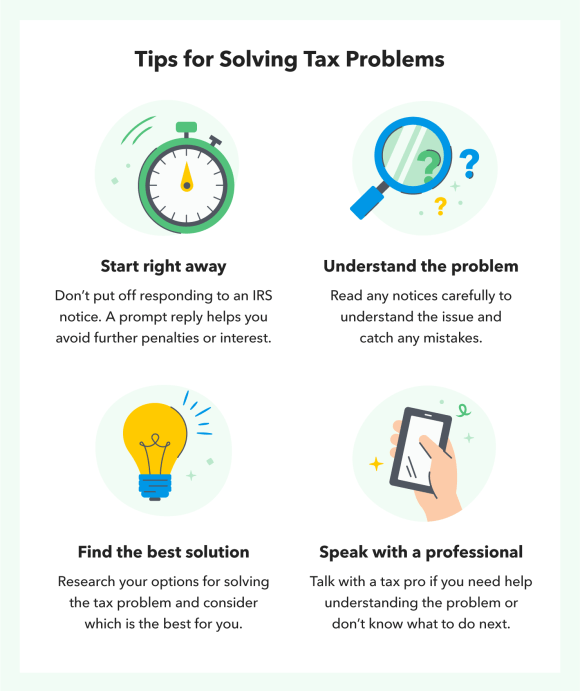

How To Solve Tax Problems: 4 Essential Tips

Whether you’re dealing with a tax audit or have unpaid taxes, tax problems may seem daunting to resolve. It’s important to take a deep breath and remember that these issues are more common than you’d think. Follow these tips to help you down the right path to fix your situation.

Get Started As Soon As Possible

If you’ve received a notice or letter from the IRS, plan to respond by the designated deadline. Replying in a timely manner and supplying the necessary documentation helps avoid miscommunication with the IRS.

The IRS will examine your response and any evidence you provided to back up your claims. This process can take months to resolve, and starting right away prevents it from going on longer than is necessary.

Understand the Problem

Understanding the issue is essential to resolving it. Always read your letter carefully to see what the tax problem is and what steps you should take to fix it. Even if you don’t agree with it, follow all instructions for responding and provide evidence and records that back up your claim.

Find the Best Solution for Your Situation

Remember to always do some research on what solutions are available to you. It’s possible to appeal many types of tax problems like a tax audit or underreported income. You can also discuss ways to waive penalties or accommodate your financial situation through payment plans.

No matter what moves you made last year, TurboTax will make them count on your taxes. Whether you want to do your taxes yourself or have a TurboTax expert file for you, we’ll make sure you get every dollar you deserve and your biggest possible refund – guaranteed.

[ad_2]

Source link