[ad_1]

The 2023 version of the International Tax Competitiveness Index is the 10th edition of the report. Over the years, many different researchers at the TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

Foundation have worked on the report, several new members of the Organisation for Economic Co-operation and Development (OECD) have been added, and various methodological changes have taken place.

One thing that has remained consistent is our work to ensure that the latest methods are applied to all years so that one can compare the Index data over time in an apples-to-apples manner.

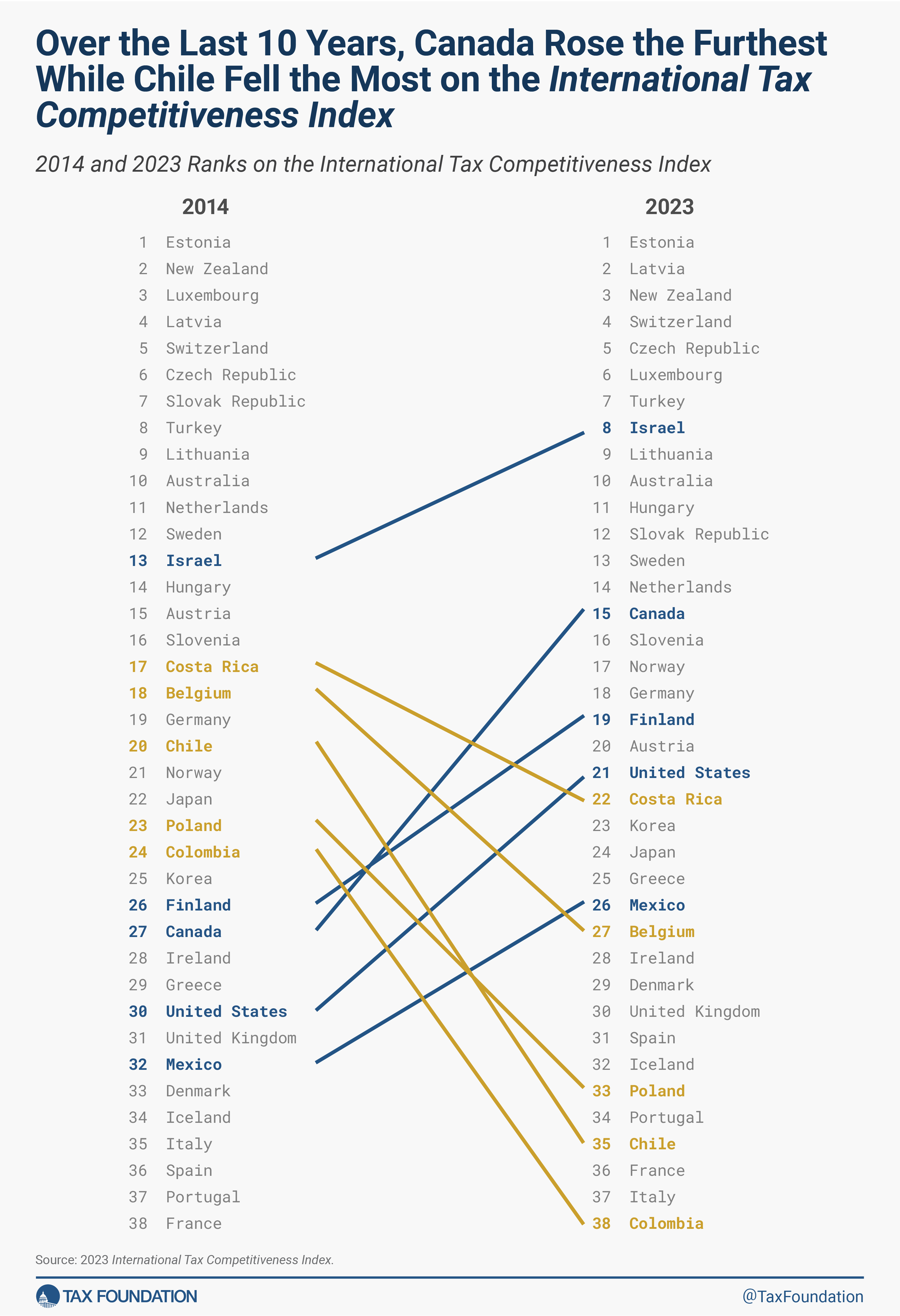

This allows us to look back and see how country ranks have changed over time and be able to identify the largest movers and shakers over the last 10 years.

The five countries that saw the largest improvements in their rank over the last 10 years are:

- Canada, which ranked 27th in 2014 and now ranks 15th

- The United States, which ranked 30th in 2014 and currently ranks 21st

- Finland, which ranked 26th in 2014 and is now at 19th

- Mexico, which placed 32nd in the 2014 rankings and has climbed to 26th

- Israel, which ranked 13th in 2014 and has risen to 8th

The five countries that fell the furthest in the rankings between 2014 and 2023 are:

- Chile, which ranked 20th in 2014, and now ranks 35th

- Colombia, which ranked 24th in 2014, and currently ranks 38th

- Poland, which ranked 23rd in 2014, and is now at 33rd

- Belgium, which placed 18th in 2014, and has now fallen to 27th

- Costa Rica, which ranked 17th in 2014, and is now at 22nd

Highlighting the Good

Canada adopted full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs.

for some short-lived assets in 2019, following the United States, which boosted its rank on the Index and helped spur new capital investment critical for long-term growth. Canada and its provinces also decreased the combined consumption taxA consumption tax is typically levied on the purchase of goods or services and is paid directly or indirectly by the consumer in the form of retail sales taxes, excise taxes, tariffs, value-added taxes (VAT), or an income tax where all savings is tax-deductible.

burden over the years while broadening the base from 38 to 50 percent of final consumption. Its rank on the Index also benefits from the lack of wealth, estate, or inheritance taxAn inheritance tax is levied upon an individual’s estate at death or upon the assets transferred from the decedent’s estate to their heirs. Unlike estate taxes, inheritance tax exemptions apply to the size of the gift rather than the size of the estate.

es.

The United States adopted a broad tax reform package in 2017. Since then, some core elements of the reform, such as full expensing for machinery and equipment, started to phase out. However, its lower corporate and personal income tax rates as well as its move toward a territorial tax systemA territorial tax system for corporations, as opposed to a worldwide tax system, excludes profits multinational companies earn in foreign countries from their domestic tax base. As part of the 2017 Tax Cuts and Jobs Act (TCJA), the United States shifted from worldwide taxation towards territorial taxation.

remain to this day.

Finland made moderate improvements to its tax code while refraining from the policy mistakes made by other countries. Its bank tax was abolished in 2015. Finland also improved its capital allowanceA capital allowance is the amount of capital investment costs, or money directed towards a company’s long-term growth, a business can deduct each year from its revenue via depreciation. These are also sometimes referred to as depreciation allowances.

s for machinery and equipment in 2020, a policy set to expire in 2025. To keep its rank, Finland should make the policy permanent or extend its capital allowances further.

Mexico broadened its VAT base, formerly the most narrow in the OECD, from 31 to 37 percent of final consumption. It also reduced the share of revenue collected outside of normal taxes on personal and corporate income, indicating a move toward more reliable and transparent taxation.

Israel’s rank has benefited from reducing its corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

rate and moderating the high progressivity of its personal income tax. It also concluded seven new double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income.

treaties, lowered its withholdingWithholding is the income an employer takes out of an employee’s paycheck and remits to the federal, state, and/or local government. It is calculated based on the amount of income earned, the taxpayer’s filing status, the number of allowances claimed, and any additional amount of the employee requests.

tax rates, and remains the only OECD country without thin capitalization rules, while other countries added new anti-avoidance provisions. One of its strengths is having a relatively low value-added tax (VAT)A Value-Added Tax (VAT) is a consumption tax assessed on the value added in each production stage of a good or service. Every business along the value chain receives a tax credit for the VAT already paid. The end consumer does not, making it a tax on final consumption.

rate that applies to a broad base.

Learning from the Bad

Chile completely abolished loss carrybacks in 2017 and increased both its corporate income tax and capital gains rates over the past few years. The largest improvement over the past decade, full expensing for buildings, machinery, and intangible assets, remained a temporary policy that was phased out in 2023.

Colombia has fallen to the last rank as its tax policy deteriorated along various dimensions. Its VAT rate increased from 16 percent to 19 percent while its VAT base has become one of the narrowest in the OECD. Additionally, Colombia increased its corporate income tax rate to 35 percent, the highest in the OECD. It also introduced capital duties and a net wealth taxA wealth tax is imposed on an individual’s net wealth, or the market value of their total owned assets minus liabilities. A wealth tax can be narrowly or widely defined, and depending on the definition of wealth, the base for a wealth tax can vary.

.

Poland has introduced a patent boxA patent box—also referred to as intellectual property (IP) regime—taxes business income earned from IP at a rate below the statutory corporate income tax rate, aiming to encourage local research and development. Many patent boxes around the world have undergone substantial reforms due to profit shifting concerns.

and a digital services tax while tightening its cross-border rules in recent years. Poland also has multiple distortionary property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services.

es with separate levies on real estate transfers, estates, bank assets, and financial transactions.

Belgium has limited carryforwards to 40 percent of net operating losses while its capital allowances declined across all classes of investments. It also introduced an annual tax on securities accounts and—effective in 2024—imposed strict CFC and thin capitalization rules. Belgium’s allowance for corporate equity is set to be abolished in 2024, further decreasing its rank.

Costa Rica started taxing capital gains and increased its corporate income tax bracketA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat.

s to five, the most in the OECD. At the same time, Costa Rica has not changed its restrictive approach to carryover provisions and still offers no cost recoveryCost recovery is the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker’s productivity and wages.

for intangible assets. Its international treaty network lags behind as the OECD’s narrowest with only three tax treaties.

The Index provides lessons for policymakers considering ways to remove distortions in their tax systems and remain competitive against their peers. The further up a country moves on the Index, the more likely it is to have broader tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates.

s, relatively lower rates, and policies that are less distortionary to individual or business decisions. Falling on the Index reveals a policy preference for narrow tax bases, special tax policy tools, and rules that make compliance more difficult.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share

[ad_2]

Source link