[ad_1]

I write this as part of the background data for the Taxing Wealth Report 2024 that I am now working on and thought it worth sharing here:

If you ask most people in the UK about taxes the one tax they will, almost invariably, think of is income tax. So do most politicians and commentators. That is why it is incredibly common to hear the claim that the wealthiest one percent of people in the UK pay more than 25% of all tax[1]. This is based upon the proportion of income tax that they supposedly pay, when it is unlikely that they pay nothing like the same amount of any other tax.

There are, in fact, very many taxes in the UK, even if none is as big in terms of revenue raised as income tax.

The data

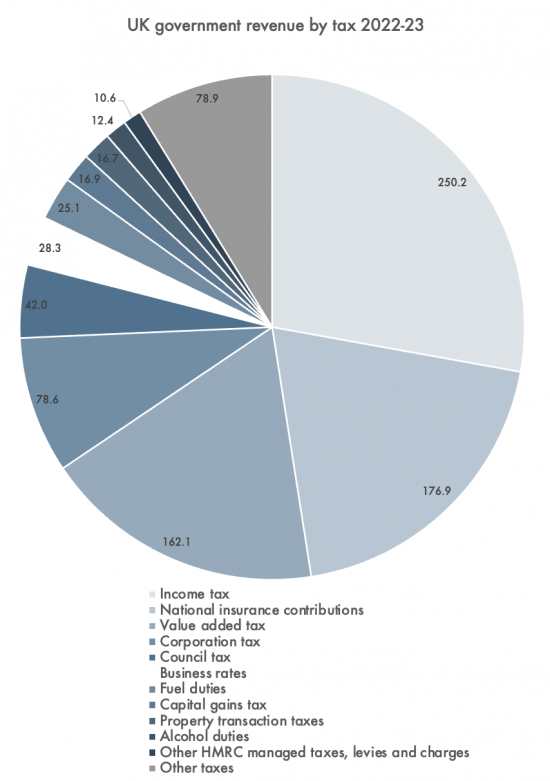

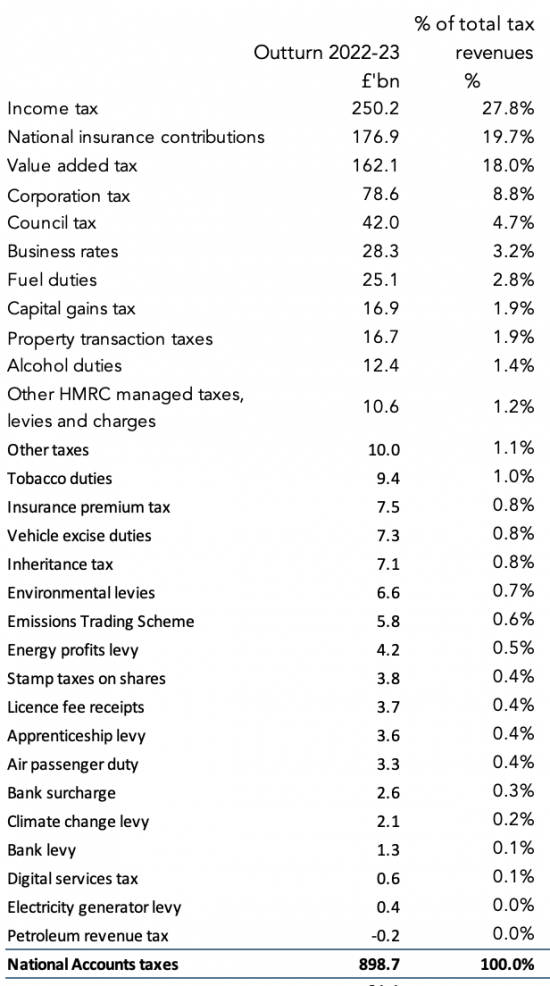

The following chart summarises, the total sum paid for all the major UK taxes in the year to March 2023[2]:

The taxes paid are listed below the chart in order of size, working clockwise round the chart.

A more detailed list is as follows:

UK taxes paid by type 2022-23

Categorisation by type of tax

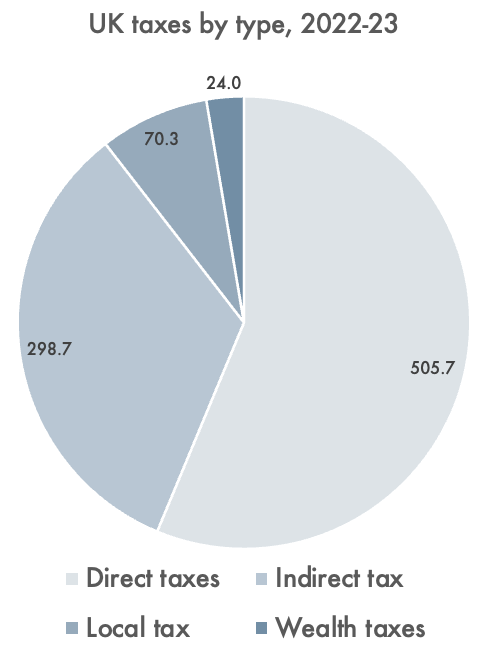

Of these taxes, some are described as direct taxes. This means that they are taxed on income, whether of individuals or of companies. Income tax, national insurance and corporation tax are the most significant direct taxes.

Some taxes are local. Council tax and local business rates are by far the most significant of these.

Others are described as indirect taxes. They are, broadly speaking, charged on the value of sales made. Some are, in effect, charges. The largest of these are VAT and duties, but stamp duties can also be put in this category. Most of the smaller taxes listed are indirect taxes.

Few of our taxes are charged on wealth. Both inheritance tax and capital gains tanks could be described as direct taxes, however, they might be better to described as taxes on either wealth, or income derived from wealth.

Using these categorisations, total UK tax paid looks like this:

The Taxing Wealth Report 2024 is unsurprisingly, given its title, concerned with the taxes paid by the wealthiest people in the UK. However, because there are no taxes not paid by wealthy people, that means that every tax is potentially within its scope. That said, because of the difficulties that direct taxation of wealth creates, it has limited its focus to increasing the amounts of tax that might be paid by those with wealth in the UK that can be achieved by modifying existing taxes, or by reducing tax reliefs given by law at present that reduce the amount of tax paid.

Given that the aim is on revenue raising this does, inevitably mean it has also focussed on the largest taxes in the UK as noted above.

Footnotes

[1] The figure is itself uncertain. It depends on the basis of calculation. What is undoubtedly true is that the top 3% or so of income earners pay 25% of all income tax, but it is most likely that they pay much less of overall tax than that.

[2] Based on table A5 here: https://obr.uk/download/economic-and-fiscal-outlook-november-2023/?tmstv=1701349270

[3] This note is also available as a PDF here.

[ad_2]

Source link