[ad_1]

Key Findings

- Alcohol is one of the most highly taxed products in the United States. The federal government takes a categorical approach to alcohol taxation (e.g., taxing based on classification such as beer, wine, or spirits), to which states add their own taxes for products in each category.

- Alcohol production has been one of the most innovative spaces in the U.S. economy. New products have further blurred existing categorical lines. The changing product landscape suggests the need for a change in taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

policy. - Currently, alcohol taxes are non-neutral. Per ounce of alcohol, spirits are taxed at more than three times the rate of wine and double that of beer.

- Inefficiencies in the federal alcohol tax system are exacerbated by policies such as the rum cover-over, rum production subsidies, wine production subsidies, and spirit tax rebalancing (Section 5010).

- An alcohol by volume (ABV) tax could replace the existing alcohol tax system. An ABV tax would make alcohol taxes simpler, more transparent, and substantially more neutral than the current system.

- If a full revamp of the alcohol tax is infeasible, policymakers should add several new tax categories to modernize the current categorical system.

Introduction

There is nothing quite like the feeling of settling down with your favorite alcoholic beverage. Whether it’s the warmth of a fine whiskey, the effervescence of a well-chilled beer, or the crispness of a glass of wine, enjoying these libations has long been intertwined with social, cultural, and personal experiences. But before any consumer can enjoy their drinks, alcoholic beverage retailers, wholesalers, and producers must navigate a complex web of regulations and taxes.

Alcohol is one of the most highly taxed products in the United States. The U.S. takes a categorical approach to alcohol taxation, wherein alcohol products are classified into categories (the largest being beer, wine, and spirits) and taxed accordingly. Each state adds its own tax for products in each category.

When categorical taxes were initially implemented, clear delineations separated the categories. Beer, wine, and spirits were very different products, each having a significantly different alcohol content. Even today, most beers have an alcohol content of around 5 percent, wines have 10-16 percent alcohol content, and spirits tend to have around 40 percent alcohol by volume. With differing alcohol contents and corresponding risks for alcohol abuse and external harms, higher tax rates on clearly delineated categories of products would be a practical approach. However, a categorical system does not work as well in a rapidly changing product environment.

Recently, alcohol production has emerged as one of the most innovative spaces in the U.S. economy. Producers have developed a myriad of new products to further enrich a well-established industry. While market participants have been quick to adapt to changing market conditions, the historic categorical tax policy has struggled to keep pace with market innovations.

Newer products like hard seltzers and ready-to-drink cocktails straddle categorical lines and result in non-neutral and often counterintuitive tax policy. Despite the recent permanent adoption of the Craft Beverage Modernization Act (CBMA) in late 2020, more opportunities exist to improve the tax landscape for one of the nation’s oldest products.

The changing product landscape suggests the need for a change in tax policy. Governments grappling with fiscal responsibilities and public health concerns, and companies battling for market share, have turned alcohol taxation into a contentious issue. This paper delves into the intricate landscape of alcohol taxes, summarizing the current alcohol tax landscape and highlighting innovations that have blurred the categorical tax lines. We then explore a framework for the continued modernization of alcohol taxation. This framework provides options for broad criteria to simplify, and create more certainty in, the alcohol tax system.

The Alcohol Tax Landscape

The economic justifications for special taxes applied to alcohol are based on reducing external harms created by consuming alcohol. Excise taxes increase market prices and decrease (legal) consumption, thus decreasing the external harms that accompany alcohol consumption, such as drunk driving, intoxicated violence, and property damage. Alcohol taxes also generate revenue, which can be used to help mitigate the harms of alcohol consumption by funding anti-addiction programs, enforcement of and incentives for sober driving, and education programs.

Alcohol taxes are one of the nation’s oldest taxes. The federal government levied its first whiskey tax in 1791, 10 months before ratifying the Bill of Rights. From its initial imposition, and the Whiskey Rebellion that followed, alcohol taxes have been contentious.

The disaster of Prohibition provides clear evidence of how wrong alcohol policy can go. The 18th Amendment to the Constitution, ratified in 1919, prohibited the sale of most alcohol, and the Volstead Act (1919) provided for its enforcement. Prohibition was repealed with the 21st Amendment to the Constitution in December 1933.

Beginning in 1934, the federal government moved to a legalize-and-tax approach to alcohol. Over the better part of the next century, federal tax rates gradually ratcheted higher and higher.

The Craft Beverage Modernization Act (CBMA) of 2020 provided some tax relief to vintners, distillers, and brewers. CBMA made permanent several tax cuts that were implemented in the 2017 Tax Cuts and Jobs Act, including reduced rates on beer and distilled spirits, making certain tax credits for wine permanent, and permanently fixing meads and low-alcohol wines in a lower tax category.

Current Alcohol Tax Rates

Alcohol is taxed by the federal government, state governments, and some municipalities. Alcohol taxes vary by category, based on ingredients and how it is produced.

The federal government applies a different tax rate to products in each category.[1] Beer taxes range from $0.11 to $0.581 per gallon based on production, location, and quantity. Most wines are taxed at $1.07 per gallon. Spirits products have tax advantages for the initial gallons distilled, but spirits taxes increase quickly, with large producers paying $13.50 per proof gallon.[2]

Spirits are taxed more heavily, even between products containing the same alcohol content. Consider three “standard drinks,”[3] each containing 0.6 ounces of alcohol: a 12-ounce beer containing 5 percent alcohol, a cocktail made with 1.5 ounces of 40-proof spirits, and a 5-ounce glass of wine with 12 percent alcohol content. Even though the alcohol content of each beverage is the same, the federal taxes applied to the cocktail are more than three times the rate applied to the wine and more than double the rate applied to beer.

States also apply differential tax rates by alcohol product category.

Beer

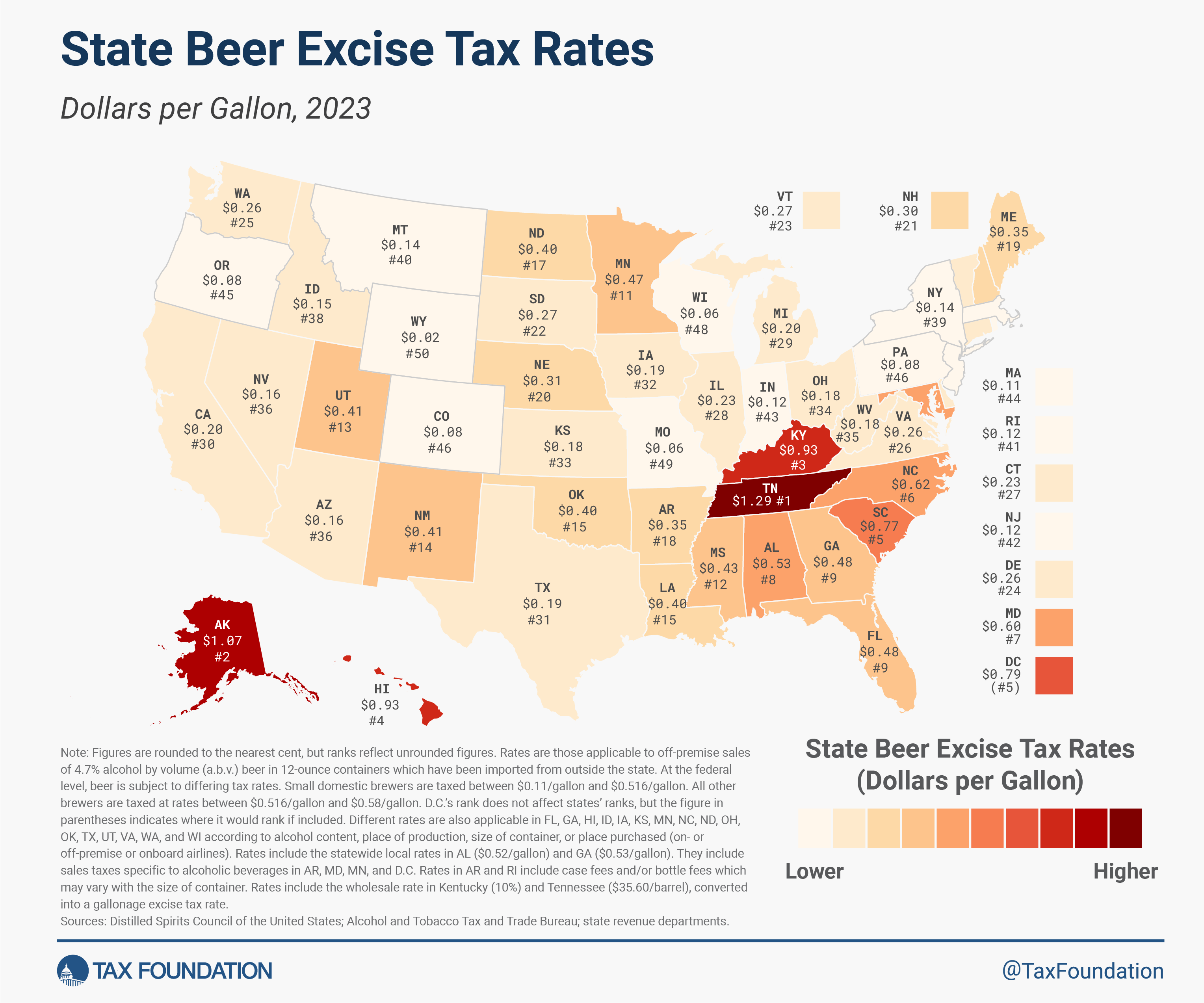

All 50 states and the District of Columbia collect their own excise taxes on fermented malt beverages. In addition to excise taxes specifically levied on beer, general sales taxes from state, and sometimes municipal governments, are tacked on after the prices of goods are subtotaled.

The following map shows state beer excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections.

rates, which vary widely. Wyoming levies the lowest tax rate on beer at $0.02 per gallon, followed by Missouri and Wisconsin at $0.06 per gallon.[4] Tennessee charges the highest beer tax at $1.29 per gallon, followed by Alaska at $1.07 per gallon.

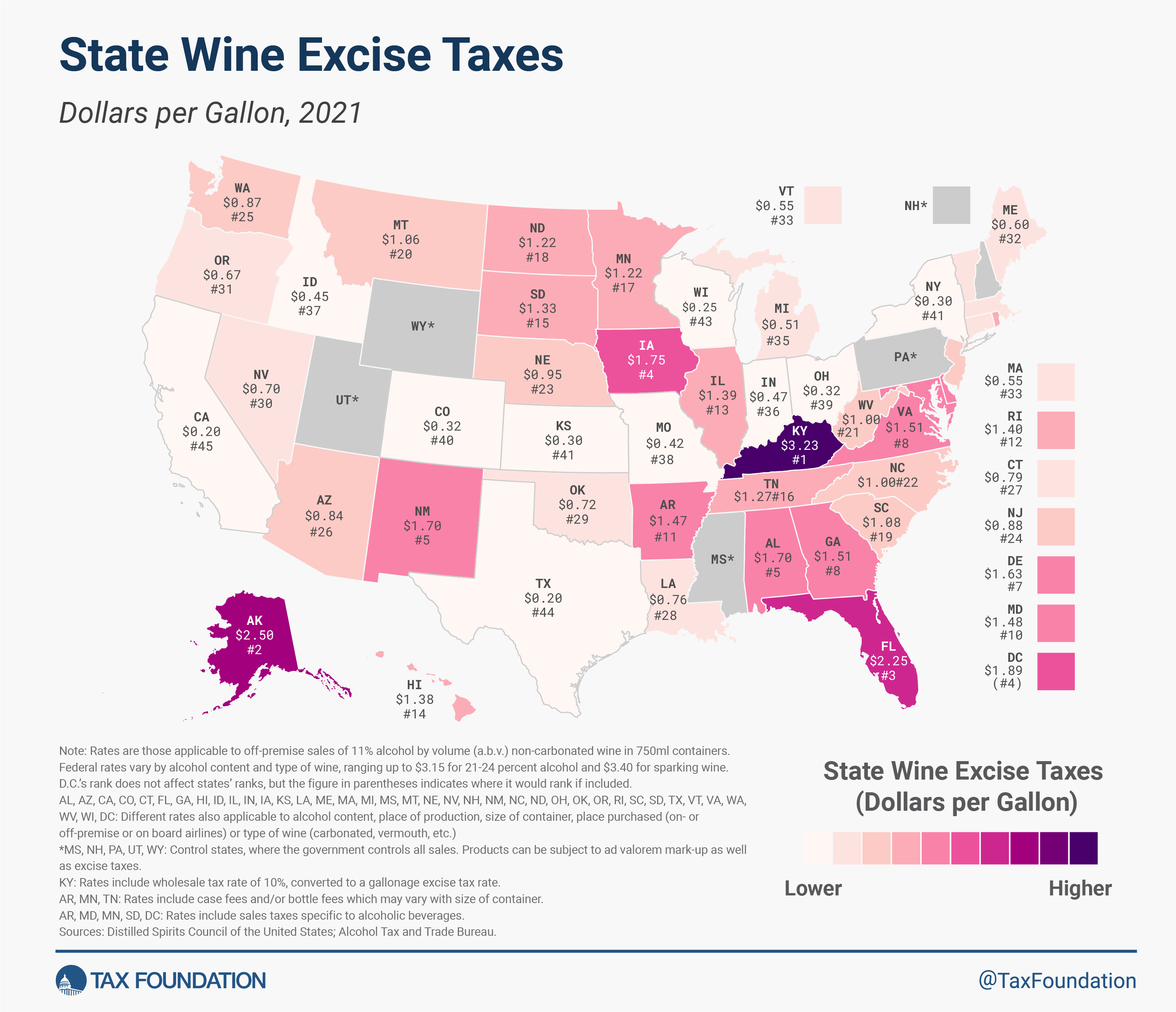

Wine

States tend to tax wine at a higher rate than beer but at a lower rate than distilled spirits. Kentucky levies the highest state wine tax at $3.23 per gallon, well above Alaska’s second-place $2.50 per gallon.[5] The lowest excise taxes can be found in California and Texas, which both levy a tax of $0.20 per gallon.

Spirits

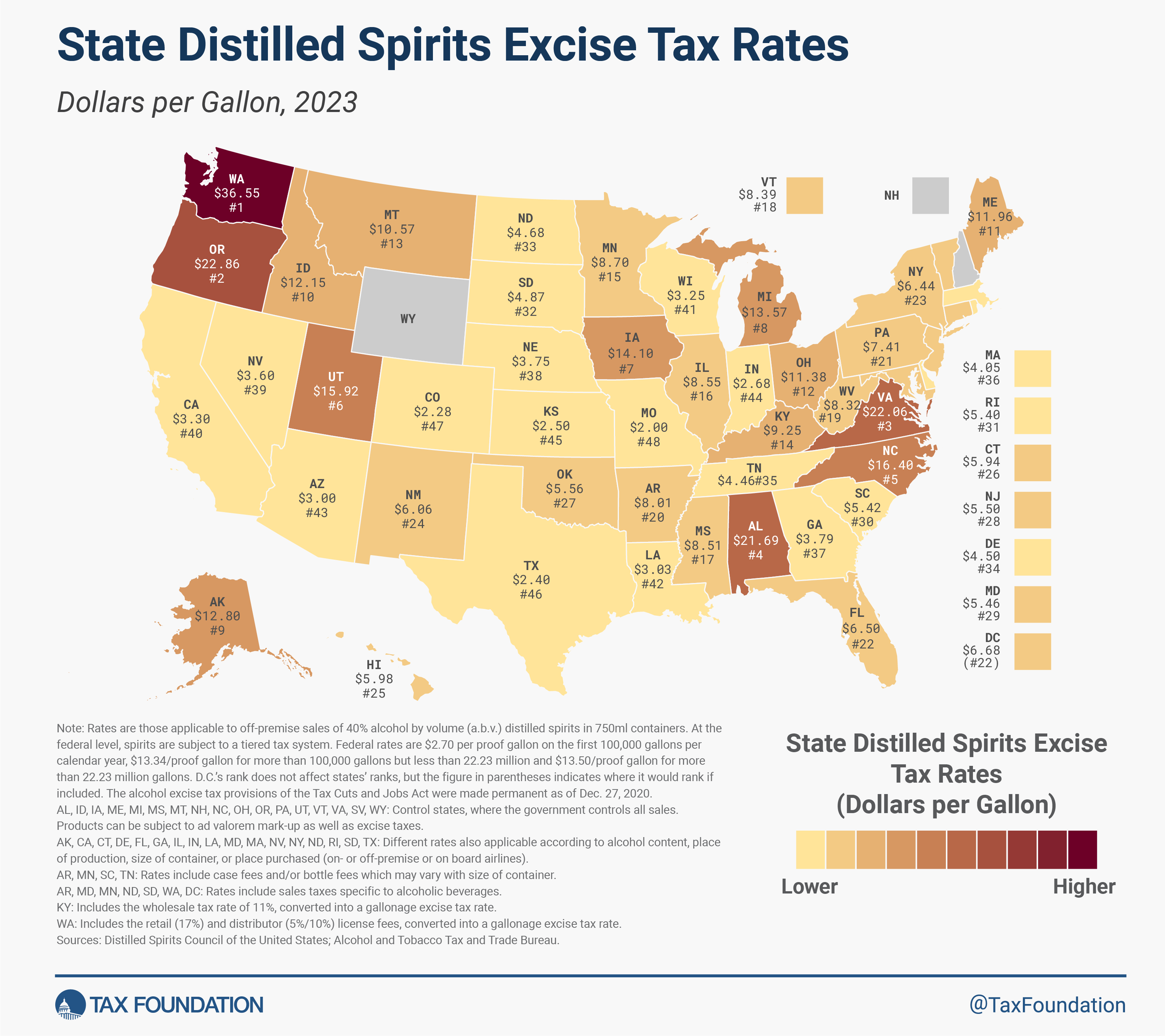

Like the federal government, most states apply the stiffest tax rates, and more restrictive regulations, to distilled spirits. States also levy special fees and taxes on spirits, including case and bottle fees, special sales taxes on spirits (separate from, and in addition to, the excise tax), wholesale taxes, and retail and distributor license fees.

In 17 states, the government operates a monopoly of state-controlled liquor stores. In these control states, the state can artificially inflate prices in lieu of levying a formal tax. The data in Figure 3 represent the implied excise tax rates in those states with government monopoly sales.[6]

Washington levies the highest excise tax rate on distilled spirits at $36.55 per gallon, followed by neighboring Oregon at $22.86 per gallon. Distilled spirits are taxed the least in Wyoming and New Hampshire. These two control states gain revenue directly from alcohol sales through government-run stores and have set prices low enough that they are comparable to buying spirits without taxes.

Building on a Poor Foundation

The current tax system has several flaws that often compound to make the alcohol tax landscape far more complex and inefficient than necessary.

First, the categorical system is not all-inclusive. Governments must explicitly define the products in a given tax category. Because alcohol can be produced from so many different ingredients and with different methods, existing definitions fail to delineate what products fit into which tax category, if any. This effect is exacerbated by recent innovations that have blurred the existing categorical lines.

Second, the different tax rates applied to the various categories make alcohol taxes non-neutral. Alcohols created from certain processes or raw ingredients receive preferential tax treatment. The differential tax treatment of various products offers a dizzying array of incentives for producers to do things other than invest in creating new and better products.

Finally, these differential tax effects are compounded with the creation of production subsidies. Many of the production subsidies seek to rebalance the effects created by the differential tax rates but often end up rewarding only a select few producers.

Rum Cover-Over and Rum Subsidies

Distilled spirits are subject to a federal excise tax in the U.S. as high as $13.50 per proof gallon. Of this, $10.50 per proof gallon of the federal excise tax on rum produced in Puerto Rico and the U.S. Virgin Islands (USVI) is automatically returned to the territories based on their share of domestic production. The roughly $700 million in annual excise tax revenue going back to the islands is often referred to as the “rum cover-over.”

Beginning in the early 1990s, the $10.50 per proof gallon returned to Puerto Rico and the USVI temporarily increased to $13.25. The higher rate of tax collections returned to the territories would often be included in tax extender packages. The additional revenue was welcomed by the territories, but because the additional revenue was constantly part of a temporary tax extender package, the revenue was difficult for the territories to count on reliably. The revenues from the rum cover-over are now a battleground both between members of Congress and between beer and spirits industries.

In an ideal fiscal world, the rum cover-over would be innocuous. Similar to the way most gasoline tax revenues are earmarked for road expenditures, returning federal excise taxes to the territories responsible for producing much of that revenue would be a simple fiscal shortcut.

The controversy surrounding the cover-over revenues is tied to an existing battle over subsidies provided to rum producers in Puerto Rico and the USVI and the disproportional tax rate charged to spirits. As discussed above, the federal tax rate for spirits is more than double the tax applied to beer with the same alcohol content. At the same time, rum producers in Puerto Rico and USVI have received substantial subsidies and tax breaks for the operations in the territories, provided by the territories but functionally funded by the cover-over.

The result is that spirits producers are more heavily taxed than producers of other alcohol, and certain producers are heavily subsidized while other mainland rum producers receive no such benefit. At the very least, the rum cover-over program would be greatly improved with greater transparency requirements to help clarify the actual effects of the program. The subsidies and cover-over could be removed entirely in the absence of a federal tax on alcohol or in a system of equalized tax rates.

Wine Production Tax Credits and Section 5010

Wine receives both production subsidies and a favorable tax treatment compared to other types of alcohol. The CBMA extended the small domestic producer tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly.

to all wine producers regardless of size. The following tax credits are available to all wine producers each calendar year:

- $1.00 per gallon on the first 30,000 gallons produced or imported into the United States

- $0.90 per gallon on the next 100,000 gallons

- $0.535 per gallon on the next 620,000 gallons

The impact of wine production tax credits is magnified when wine is produced and then added to spirits. Internal Revenue Code Section 5010 provides a credit against excise tax for wine and flavors content in distilled spirits. The Section 5010 credit can reduce tax owed because wine and flavors are generally taxed at lower rates than distilled spirits.

The motivation for 5010 was simple. Before 1980, all ingredients used in producing a spirit (e.g., wine, flavors, and other ingredients) were taxed individually before being combined into a final product. The Distilled Spirits Tax Revision Act of 1979 changed the application of the tax to the final product, substantially increasing the tax rate applied to all ingredients in the production of spirits. To compensate distilled spirits producers who used lower-taxed ingredients in the production of their products (e.g., wine and flavors), Congress amended the Internal Revenue Code to provide the 5010 tax credit.

As a result of Section 5010, most spirits producers use wine and flavors to substantially reduce their effective tax rate. Table 2 shows a hypothetical example of the total cost and tax burden for producing spirits with various levels of wine content.

The more wine that spirits producers add to their product, the lower the tax. Once again, the non-neutrality of the tax code regarding alcohol products influences production and the kinds of products available for consumption.

Blurred Lines of a Categorical System

Over time, producers innovate. New products are developed and consumption changes. The alcohol industry has been rife with innovation, with consumers reaping the rewards of new products.

Craft brewing revolutionized the beer industry, exponentially increasing the number of beers available to American consumers. According to the Brewer’s Association, the number of breweries operating in the U.S. increased 26-fold in the past 30 years, from 359 in 1992 to 9,709 in 2022.[7]

The increase in craft brewing not only diversified the flavor profile of the products on the market, but the alcohol content in these products also often diverged substantially from the traditional 4-5 percent in large batch brews (e.g., Bud Lite, Miller Genuine Draft, Coors, etc.). Craft India Pale Ales (IPAs) have a significantly higher alcohol content than the most popular light American lagers. Double IPAs often have 10 percent alcohol by volume or more, putting them closer in alcohol content to most wines than beers.

Other products blur the lines even further. Malt liquor, a higher-alcohol-content beer brewed with extra malt, by its own name is such a clear category stratifier.

Many ready-to-drink cocktails are distilled spirits drinks. After combining the spirit with a mixer (e.g., a Jack and Coke), the final product available to purchase has an alcohol content closer to a beer than a bottle of liquor.

Hard seltzers have been around for a few decades in the U.S., but their popularity exploded in the past five years. Originally designed out of consumer love for vodka sodas and similar carbonated alcoholic drinks, many hard seltzers contain no spirits at all. Hard seltzers are often made from fermented cane sugar, though other times hard seltzers can be brewed from malted barley or made with vodka. While malt-based seltzers are produced with grain, they create a final product that bears little resemblance to its malt-based beer cousin. Hard seltzers often have an alcohol content similar to that of beer, but the way in which the final product is taxed depends on the ingredients used. Vodka-based seltzers are charged a stiffer tax rate than malt-based seltzers.

Finally, other alcohol products simply don’t fit into any existing category. Hard cider is made primarily from apples and pears and was such an outlier that Congress passed new tax legislation in December 2015 to create a new category and tax rate for hard ciders. Kombucha is a fermented tea; it is naturally alcoholic, but the alcoholic content can be increased through strategic fermentation, resulting in popular products with alcohol by volume similar to beer. Numerous other products don’t fit well into a three- (or four- or five-) category tax system.

Though tax policy can adapt to blurred categorical lines, that change is often slow, requires legislative attention, and adds substantial complexity to the tax system.

A Framework for Alcohol Taxation

Taxes applied to alcohol should be simple, transparent, neutral, and stable. When well-designed, alcohol taxes should efficiently provide tax revenue to fund programs to address external harms and anti-addiction programs associated with alcohol consumption, while simultaneously serving as a monetary disincentive for overconsumption.

With a low rate and a broad base, alcohol taxes should encourage productive (product-improving) innovation and discourage unproductive (rent-seeking and regulatory capture) expenditures. The tax system can provide a level playing field for all producers and adapt to an innovative and changing marketplace environment.

An Alcohol by Volume Tax

An ideal alcohol tax designed from scratch would eliminate tax categories and production subsidies. Any product containing alcohol would be taxed based on its alcohol content, regardless of the process of extracting the alcohol (e.g., distilling, mashing, or steeping) or the initial starting ingredient (grapes, grain, potatoes, sugar cane, apple, pear, honey, etc.). The alcohol by volume (ABV) tax ensures neutrality by taxing all drinks containing the same amount of alcohol at the same tax rate.

A linear tax would be the simplest option. For illustrative purposes, assume all “standard drinks” (Table 1 above) containing 0.6 ounces of alcohol were taxed at $0.04 (or $0.66 per 1.0 oz. of ethyl alcohol, which also equals $4.25 per proof gallon). That is slightly less than the rate currently applied to wine—about $1.02 per gallon of wine and $13.33 per barrel of beer.

Table 3 below illustrates the hypothetical tax rate for a variety of products. For a linear tax, the tax rate increases proportionally for all types of alcohol. A beer with 10 percent alcohol content is taxed twice as much as a beer with 5 percent alcohol content: $0.08 and $0.04, respectively.

The harms of alcohol potency and consumption may increase exponentially, not linearly. Consuming 8 oz. of alcohol would be more than twice as dangerous and harmful as consuming 4 oz. of alcohol. In this case, alcohol taxes should also increase exponentially with potency. A drink with 1.2 oz. of alcohol would be charged more than twice as much tax as a drink with 0.6 oz. of alcohol. Such policies are imperfect, as drinking 8 oz. of alcohol has similar effects whether consumed through one drink or multiple drinks, but the pace of consumption has relevance for policy.

The table also shows an example of an increasing tax rate based on alcohol potency. The final column illustrates a tax rate in which the base rate ($0.066 per oz. of pure alcohol) is then combined with a rate that is 10 times the squared amount of the base rate.[8]

The rate for a 3 oz. drink with a 40 percent ABV or 1.2 oz. of alcohol would be $0.143, more than twice the rate for a similar drink with half the alcohol content. The increasing tax rate by alcohol content would incentivize consumption of lower alcohol content drinks. A non-linear tax would be more complex, but may better fit external harms caused by alcohol consumption.

Regardless of whether a flat taxAn income tax is referred to as a “flat tax” when all taxable income is subject to the same tax rate, regardless of income level or assets.

rate or an increasing tax rate is applied, a tax applied to alcohol by volume would be a well-targeted, neutral tax. If production subsidies are removed, this system could be revenue-neutral, even with a lower rate applied to all categories. New products could easily fit into the tax system and few changes would need to be made over time. In short, an ABV tax is well-designed.

More Tax Categories

If removing the entire alcohol tax code and starting over is infeasible, taxing bodies should consider several new tax categories to work into the current system design. Alcohol products should be taxed relative to their external harms and several new categories are needed to encompass the rapidly changing landscape of alcohol products.

The beer category would likely need to be divided into multiple categories by alcohol content for low-, medium-, and high-gravity beers. Most European countries apply a hybrid rate, in which tax rates are set separately for beer, wine, and spirits. Then, within each category, taxes increase by alcohol content.[9] Beers with higher alcohol content are taxed more heavily.

Products that fit outside of the standard beer, wine, and spirits categories would need their own category. Congress gave the blueprint for these new categories by establishing a category for hard ciders in 2015. Ciders containing up to 8.5 percent alcohol by volume are taxed federally at a rate of $0.226 per gallon. Similar categories could be made for mead, kombucha, sake, orahovac, and other products.

A new product category could offer a low-tax option for new and innovative products. This could help new companies compete for market share and give regulators time to study the specific dangers or harms of new products before assigning the product to an existing category or its own new category.

While a complete overhaul of the alcohol tax code may pose challenges, a pragmatic approach involves introducing new tax categories within the existing framework. Recognizing the diverse and changing landscape of alcohol products is essential. By tailoring tax structures to reflect the external harms and characteristics of each product, it is possible to achieve a more nuanced and equitable system within the constraints of the existing tax code.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

[1] Alcohol and Tobacco Tax and Trade Bureau, “ACE CBMA Tax Rates Table,” 2023, https://www.ttb.gov/images/pdfs/cbma/ACE_CBMA_Tax_Rates_Table.pdf.

[2] A proof gallon is one gallon of spirits that contains 50 percent alcohol. A bottle at 80 proof (40 percent alcohol) spirits, for example, would be 0.8 proof gallons per gallon of liquid.

[3] According to U.S. Dietary Guidelines for Americans, one standard drink or “drink equivalent” contains 0.6 ounces of ethyl alcohol. More information can be found at https://www.dietaryguidelines.gov/.

[4] Adam Hoffer, “How High are Beer Taxes in Your State?,” Tax Foundation, Jun. 27, 2023, https://taxfoundation.org/data/all/state/state-beer-taxes-2023/.

[5] Jeremiah Nguyen and Janelle Fritts, “How High are Wine Taxes in Your State?,” Tax Foundation, Jun. 23, 2021, https://taxfoundation.org/data/all/state/state-wine-taxes-2021/.

[6] Adam Hoffer, “How Hard Do Distilled Spirits Taxes Bite in Your State?,” Tax Foundation, Jun. 13, 2023, https://taxfoundation.org/data/all/state/state-distilled-spirits-taxes-2023/.

[7] Brewer’s Association, “National Beer Sales & Production Data,” 2022, https://www.brewersassociation.org/statistics-and-data/national-beer-stats/.

[8] For a drink with .06 oz. of alcohol, (e.g. a 12-oz. beer with 5 percent ABV), the base tax rate would be $0.04. Add to that the base rate squared. ($0.04)2 = 0.0016, multiplied by 10 = $0.016. $0.04 + $0.016 yields a total rate of $0.056.

[9] Adam Hoffer, “Beer Taxes in Europe,” Tax Foundation, Sep. 19, 2023, https://taxfoundation.org/data/all/global/beer-taxes-in-europe-2023/.

Share

[ad_2]

Source link