[ad_1]

The FT reports this morning that:

British politicians should be wary of provoking a backlash in financial markets by increasing borrowing too quickly, the outgoing head of the UK’s Debt Management Office has said, ahead of a general election expected this year.

Sir Robert Stheeman, who has overseen an eight-fold rise in the UK’s debt pile over his 21 years as the government’s borrowing chief, warned that the job of issuing bonds was getting harder and investors might increasingly act as a restraining influence on fiscal policy.

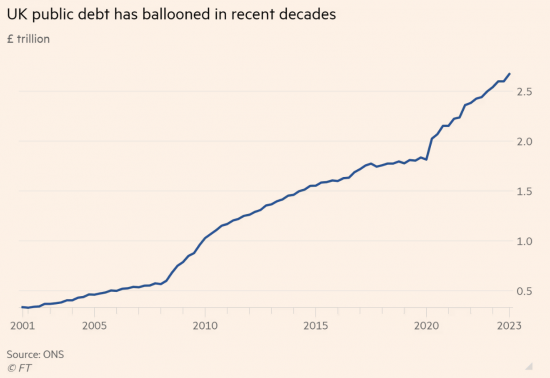

This is total nonsense. I know that because the comment is accompanied by a chart that says UK national debt has risen as follows:

As I noted before Christmas, this is simply untrue. Not only does this ignore the fact that in September 2023 £757bn of government debt is owned by the government – which makes the above chart meaningless – but it also ignores the fact that hundreds of billions of the supposed national debt simply do not exist and are simply represented by false accounting undertaken by the Office for National Statistics.

But there is more to the claim made by Stheeman than this. He is reported to have said:

Stheeman said investors’ increasing sensitivity to the scale of government borrowing had been highlighted by the crisis in gilt markets that followed Truss’s plans for £45bn of unfunded tax cuts.

I hate to excuse Liz Truss from any blame for the fiasco that was her time in office, but yet again, this is total nonsense. It is true that Kwasi Kwarteng did announce tax cuts costing £45 billion, but they were not uncosted. In conventional logic, they had to be covered by borrowing, and that does not mean they were uncosted.

But it was not that announcement that spooked markets the weekend after he spoke in September 2002. The reality was that the day before he spoke, Andrew Bailey, the Governor of the Bank of England, had announced £80 billion of quantitative tightening.

Quantitative tightening is claimed to be the reversal of quantitative easing, but again, that is total nonsense. Quantitative easing, in reality, cancels government bonds in issue. Claiming that they still exist, but in government ownership, is a farce.

And they are not sold again under quantitative tightening, in any meaningful way. Instead, quantitative tightening represents new bond issues made to force interest rates higher but without having any impact on the funds available to the government to spend. It is, in other words, a real increase in government debt for no social gain because the sole aim is to punish households and businesses that might have had the temerity to borrow. And it was quantitative tightening that spooked the markets in September 2022, not Truss and Kwarteng. We know this because by the following Monday, the Bank of England had to restart the quantitative easing process temporarily to correct the harm that they had caused.

But let’s now roll this forward to the present, and quantitative tightening is continuing. It will be £100 billion in the next year – almost four times more than Labour plans to borrow to save the planet. Those quantitative tightening bond sales will not fund the government. They won’t save the planet. They just switch central bank reserve account balances into bonds to reduce the amount of cash available within the economy so that:

- interest rates stay high

- investment stays low

- government spending is crushed, and

- we get a recession.

Those are the aims of the quantitative tightening programme – to which saving the planet is being sacrificed.

And that programme is not mentioned by Stheeman – negligently, in my opinion – or by the FT, irresponsibly, in my opinion.

In the next year, the UK government will, as a matter of fact, need to raise considerably in excess of £100 billion to fund government deficits.

It so happens that near-record levels of existing government debt needs refinancing in the next year as well.

On top of all that the Bank of England is going to sell £100 billion of debt into the market to make sure that £28 billion to fund essential investment cannot happen.

Does anyone else smell a conspiracy here? I do. The establishment is conspiring to make sure that Labour cannot borrow to fund a Green New Deal.

How to stop that? It’s really very easy. All it would take is for Labour to say it would stop giving its consent to quantitative tightening – as it can because it requires Treasury consent as does everything involving both quantitative easing and quantitative tightening – and all the money it would need to fund its programme would be available, and at lower cost.

The big question is, why isn’t Rachel Reeves saying this?

[ad_2]

Source link