[ad_1]

According to the Chancellor, all that matters about the Budget is that he meets his fiscal rule.

For reasons that no one is aware of and which no one, including the City, cares about, he thinks that his fiscal rule must require that he reduce the scale of the national debt – because that has been the story with which the Tories have been beating Labout for well over a decade.

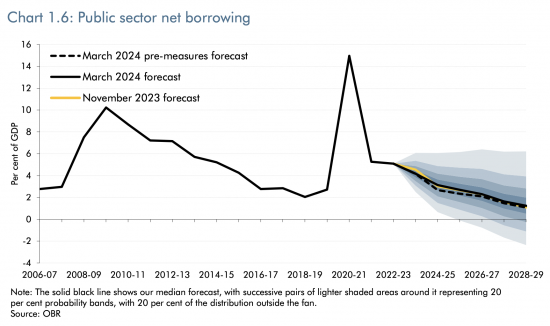

Everything in yesterday’s budget was, in that case, designed to meet this goal, and according to his own data, he does meet it:

That downward line in the middle of the fan to the right is all he cares about.

There is a cost to this. If the government borrows less, someone else has to borrow more: that’s the way in which any economy works if new money (all of which is debt-based) is to be created, which is the actual rule that cannot be broken because, unlike so-called fiscal rules, it is based on facts. So this is the sectoral forecast which shows who might be net saving and borrowing over the next few years:

Households are going to borrow more, by saving less. That’s the price of the government demanding more in tax to reduce its debt.

The overseas sector is still going to save in sterling.

And business is going to apparently start borrowing quite a lot, presumably because there is going to be a heavy investment to fund the growth that all politicians think is just around the corner, but probably is not.

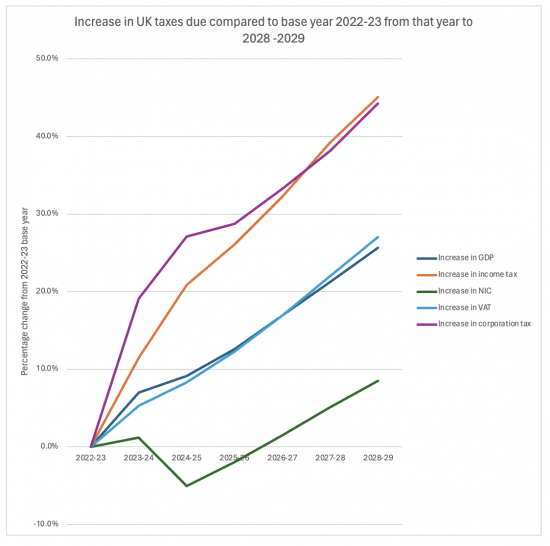

Is that likely? Yes, with regard to reduced household saving. Income taxes are going to rise much faster than GDP growth, as I showed yesterday:

That cut in household savings is likely in that case. People can’t both save and pay more tax when already pushed to their limits.

But will business invest heavily using borrowed funds so that the government might borrow less? I really do not think it is likely.

My reasons are that the GDP forecasts look like this:

GDP per head grows well for one reason: it is assumed that immigration falls, dramatically:

When someone says a behaviour pattern will change radically, they have to give a good reason: there is none here. The reality is that migration is going to increase rapidly in this world as a result of climate change: that’s the fact, and the above chart is not.

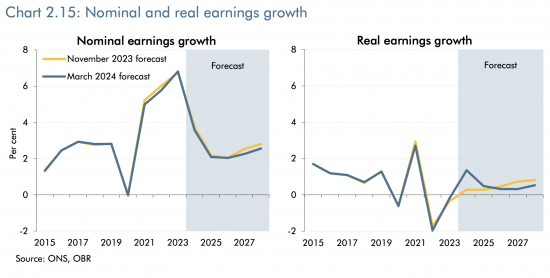

In that case, this chart on nominal and real earnings growth looks to be fanciful:

Rea; earnings growth of less than 1% is incredibly low and does not inspire business confidence or stimulate considerable investment. If GDP growth is actually going to be much more population-based than the OBR suggests, then even that growth is in doubt.

Can I, in that case, see the fall in debt that Hunt predicts? I can’t, I admit.

But I can still see the tax explosion.

Labour really does need to say how they are going to deal with all of this because the state of the government’s books is now known. I am not, however, expecting to hear much at all. If you think the credit card is maxed out and everything spending commitment has to be covered by tax, as Labour apparently does, there is little wriggle room here. Sometime, Labour is going to have to do some real macroeconomics and talk about debt financing. But I will not be holding my breath in anticipation.

[ad_2]

Source link