[ad_1]

I am continuing to work on data from HM Revenue & Customs on its accounts, the tax gap and other issues related to its management of the UK’s tax system.

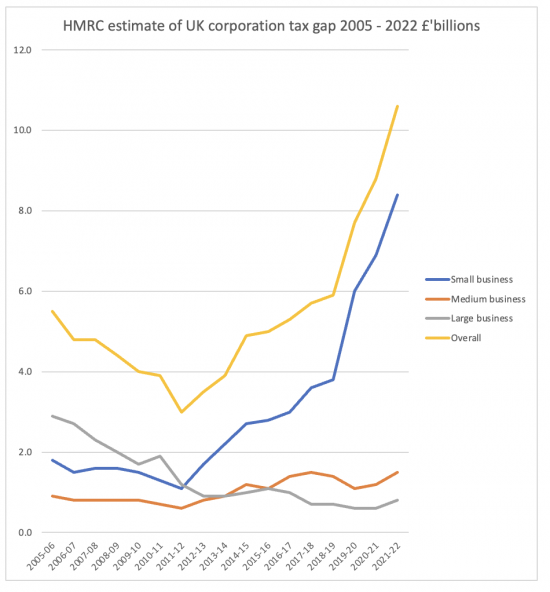

When doing so, I created this chart based on data in section five of the data files on the 2023 tax gap report, downloadable from the HMRC website:

The tax gap is the difference between the tax that HMRC think should be collected each year and they amount that they actually get.

As will be apparent, since I and others began work on tax justice the large company corporation tax gap has fallen from about 8 per cent of revenues to around 2 per cent of revenues. There are, of course, issues I would disagree with on both estimates, but that this trend is correct is, I am sure, correct.

We brought pressure to bear on the government on the large company tax gap from 2005. I created country-by-country reporting that is now in use in about 80 countries, including the UK, to tackle this issue. Large company tax abuse is no longer the issue it was. Investing further effort in it is no longer a priority in the UK and many other countries. It really is time that the current misguided tax justice movement took note: they are barking up the wrong tree when this is just about the only issue that they are still willing to talk about.

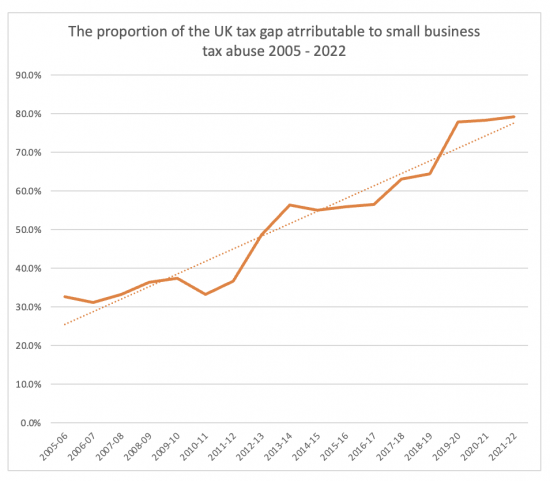

The chart does, in itself, prove why. The small business tax gap has gone through the roof. As a proportion of the total UK corporate tax gap it has changed like this:

Small company non-payment of tax is now the issue in the UK corporate tax arena. HM Revenue & Customs do, I think, still seriously underestimate this tax gap and its ramifications by suggesting that it might be £8.4 billion a year. The large business tax gap is, in their estimate, just ten per cent of that.

But the question is, why is this? I am musing on there being one very obvious cause. Look at the inflexion point in the top chart. It is 2011/12. That is when HM Revenue & Customs began to close local tax offices, end on-site PAYE inspection, and, most especially, began the process of ending almost all on-site VAT inspections of small businesses.

If VAT is not paid, sales go unrecorded. If sales go unrecorded, so too does profit. So, too, incidentally, does PAYE on the money illicitly taken from the companies involved. The small business corporation tax losses since 2012 arising as a result might have amounted to £25 billion in my estimate. The other losses will have exceeded that sum, easily. And that is all because HMRC tried to save £1 billion, maybe, a year.

We are paying an enormous price for HM Revenue & Customs mismanagement in that case. They took HM Revenue & Customs out of the community and the price we are paying for that is very high.

[ad_2]

Source link