[ad_1]

As the FT notes this morning:

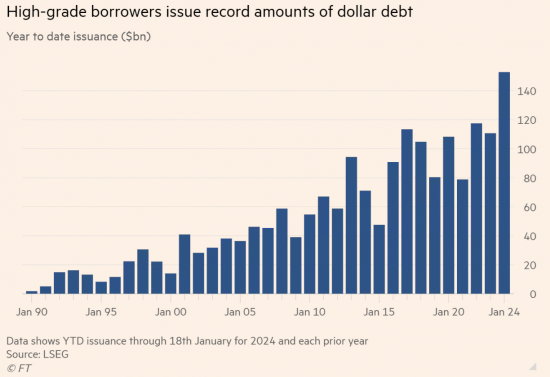

US corporate bond markets are “on fire” as companies have sold a record $150bn of debt since the start of this month, the busiest opening to the year for more than three decades.

This chart tells the story:

Literally, money is pouring into debt as people wishing to deposit funds seek their last chance to fix good rates and corporations take the opportunity to secure money while it is available.

Three thoughts.

First, whoever says debt is unattractive is wrong.

Second, there is no hint here of unsustainability, so why is that question raised of government when its offerings are of higher grade than those being snapped up in the market?

Third, why are politicians so frightened of debt when that is so obviously what markets want?

I have no answers to those questions: the politics of anti-debt sentiment make no sense.

[ad_2]

Source link