[ad_1]

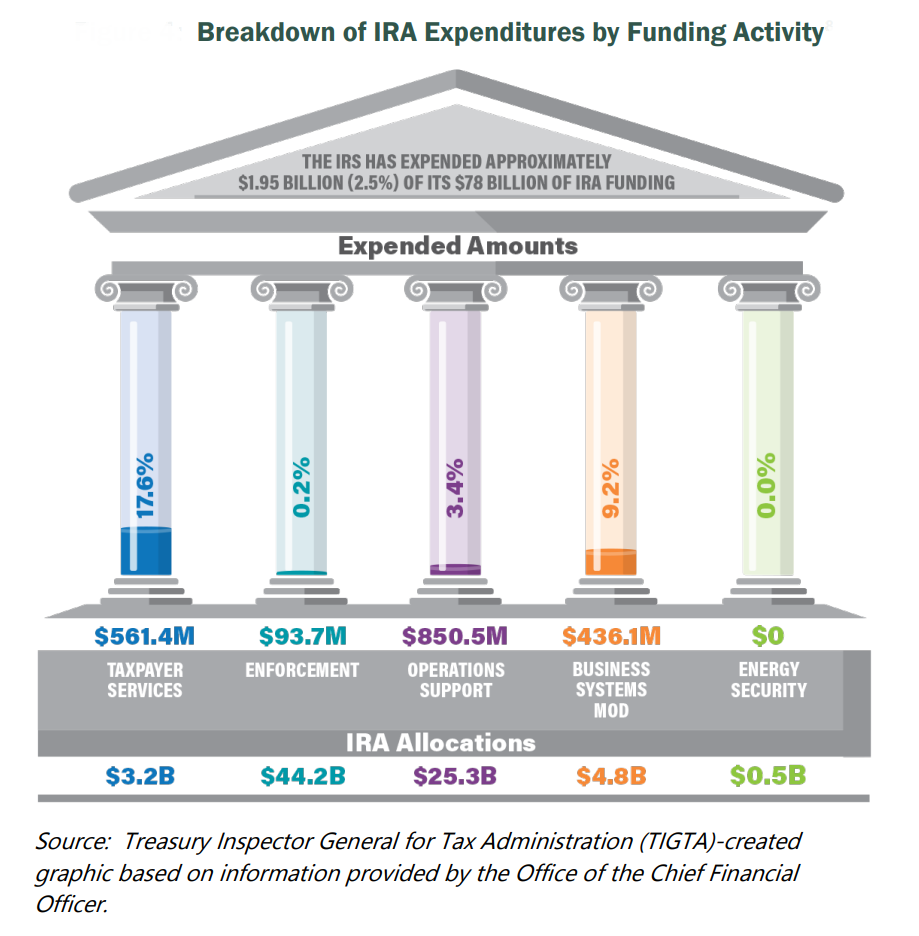

As of June 30, the IRS has spent approximately $1.95 billion, or 2.5%, of the nearly $80 billion the agency will receive from the Inflation Reduction Act, according to a new report from the Treasury Inspector General of Tax Administration (TIGTA).

TIGTA conducted its review to provide periodic reporting on how the IRS is using and accounting for Inflation Reduction Act funds. The IRS watchdog said it plans to issue this type of report quarterly going forward.

The majority of the money spent so far has gone toward IRS employees’ pay and benefits, as well as to pay contractors for what the IRS classifies as “advisory and assistance services.” These services include expenditures for the operations support and business systems modernization budget activities totaling approximately $299 million and $337 million, respectively, according to TIGTA.

In addition to its fiscal year 2023 annual appropriation of $12.3 billion, the IRS received approximately $79.4 billion in supplemental funding over a 10-year period when President Joe Biden signed the Inflation Reduction Act into law in August 2022. According to TIGTA, approximately $1.4 billion of that Inflation Reduction Act funding has been rescinded by lawmakers as part of debt ceiling negotiations earlier this summer. Another $20 billion or so will be cut and repurposed as part of the agreement last June between Biden and then-House Speaker Kevin McCarthy to suspend the debt limit and cap federal agency spending. According to IRS officials, a decision has not been reached on which appropriation areas this will impact, TIGTA said.

IRS officials indicated to TIGTA that nearly $2 billion of Inflation Reduction Act funding has been budgeted to supplement its FY 2023 annual appropriation as the amount the IRS received did not include adjustments to account for inflation, estimated at approximately $460 million from FY 2022. Additionally, the taxpayer services and operations support appropriations were already insufficient to cover normal operating expenses, and the FY 2023 annual appropriations unexpectedly zeroed out the business systems modernization account, TIGTA said.

As of June 30, the IRS reported the largest portion of Inflation Reduction Act spending was for IRS employee compensation (pay and benefits), totaling approximately $721 million, and contractor advisory and assistance services, totaling approximately $720 million.

Most of the labor costs (approximately $497 million) were in taxpayer services, TIGTA reported, including the IRS hiring additional customer service representatives to answer taxpayer telephone calls, as well as employees to staff taxpayer assistance centers for the 2023 filing season, in an effort to improve the taxpayer experience.

The report states:

According to an IRS Spending Compendium dated April 19, 2023, the IRS expects labor costs will continue to grow as the IRS plans to increase staffing levels to 105,188 by FY 2025. The planned increase in staffing will be funded from discretionary spending from the annual appropriation and Inflation Reduction Act supplemental funding. If achieved, the IRS will increase its staffing by 26,118 employees, which represents a 33% increase from its FY 2022 staffing level of 79,070.

However, TIGTA said the IRS will face considerable challenges to increase its staffing levels to 105,188. The IRS estimates it could lose 26,000 employees to either retirement or separation from the agency for the period of FY 2023 to FY 2025. This includes an estimated 14,500 employees in taxpayer services and 8,000 employees in enforcement. These losses equate to almost 33% of the employees working at the IRS as of the end of FY 2022, according to TIGTA. Therefore, in order to meet its hiring goal, the IRS will have to onboard more than 52,000 employees during FY 2023 to FY 2025 to keep pace with estimated attrition, the report said.

[ad_2]

Source link