[ad_1]

You may have itemized your tax deductions in the past if you are, for instance, a homeowner. But now, you may benefit from taking the standard deduction if the new standard deduction amount for your filing status is more than your itemized tax deductions.

If you’re not sure which is the better option this year, check out our Standard vs Itemized Tax Deduction Interactive.

In just five quick screens, you’ll understand the changes in the standard deduction and itemized deductions, and you’ll get an estimate of your deductions based on inputs. The tool also tells you if you may claim standard vs. itemized and makes recommendations for end-of-year tax moves you can make to increase your itemized deductions.

Should I take the standard vs. itemized deduction

Are you debating on whether to stick with the standard deduction or go for the itemized deduction route? Which will offer the bigger tax advantage for you will depend on your circumstances. Below, we’ll give you an overview of what scenarios typically suit the standard or itemized deduction best.

When you should take the standard deduction

Navigating your taxes can seem like a daunting task, but we’re here to help. When deciding whether you should take the standard deduction vs. an itemized deduction, it really comes down to what deductions you’d qualify for.

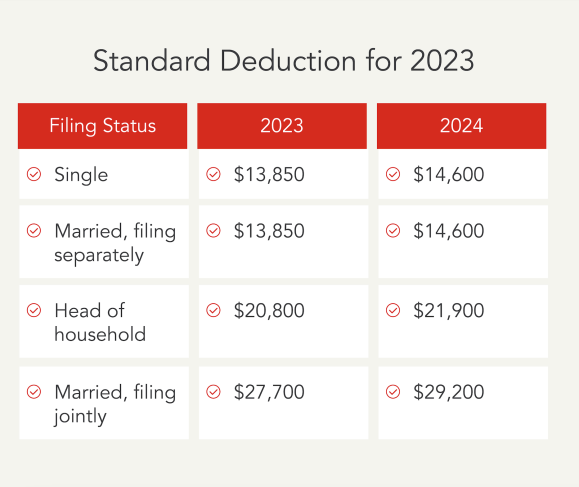

The standard deduction is a set amount based on how you file your taxes, with additional benefits for those who are 65 and older or visually impaired. The current standard deduction is:

- $13,850 for single filers

- $13,850 for married, filing separately

- $20,800 for heads of households

- $27,700 for married, filing jointly

The IRS adjusts the standard amount each year to keep up with inflation, so each year, you’ll likely need to reexamine your expenses to decide which approach is right for you.

Put simply, opting for the standard deduction makes the most sense when itemized eligible expenses don’t surpass the standard deduction amount. If you’re considering taking the standard deduction, eligible deductions such as mortgage interest, medical expenses, and charitable donations come into play when making this tax filing choice.

Usually, if you have more tax credits vs. deductions, the standard deduction is likely the better option.

When you should take the itemized deduction

So, when are you supposed to itemize deductions? Well, if your eligible expenses – like medical costs, mortgage interest, or charitable donations – add up to more than the standard deduction amount, itemizing your deduction might be the better option to lower your tax bill if the eligible expenses surpass the standard deduction.

When you’re trying to figure out which types of expenses might qualify, make sure to read up on potentially overlooked deductions.

You can use the tax deduction calculator to help provide more clarity so you can make an informed decision.

Itemized vs. standard deduction calculator

Check out our Standard vs Itemized Tax Deduction Interactive. In just five quick screens, you’ll understand the changes in the standard deduction and itemized deductions; you’ll get an estimate of your deductions based on inputs; it tells you if you may claim standard vs. itemized and makes recommendations for end-of-year tax moves you can make to increase your itemized deductions.

*Note, the Standard versus Itemized Interactive Calculator is for estimation purposes only and does not include all deductions.

What are the pros and cons of taking the itemized deduction?

Itemizing deductions on your tax return can be a game-changer for some people since it can further helps reduce their tax bill. But it’s not always as easy as it seems – understanding what itemizing tax deductions entail is key before deciding to go that route.

Itemized deduction pros

Opting to itemize your deductions over taking the standard deduction route can be a beneficial tax move. Unlike the fixed standard deduction, itemizing allows you to claim specific expenses like mortgage interest, medical costs, or large charitable donations, to name a few, potentially reducing your taxable income further if your eligible expenses surpass the standard deduction for that tax year.

Using tools like an itemized deduction calculator allows you to account for and calculate all the deductions that apply to your unique circumstances, making sure that you have a more personalized approach compared to the standard deduction.

Itemized deduction cons

There aren’t any major drawbacks necessarily, but for some, the itemized deduction appears to be a bit of a hassle because you’ll have to search records for your eligible expenses. While itemized deductions offer you more flexibility by letting you claim specific expenses to reduce your taxable income, it takes a bit more effort during tax prep.

Itemizing requires thorough record-keeping, and for some, the allure of a simpler approach with standard deductions may outweigh the potential benefits–especially if the amount you think you qualify for over the standard deduction is minimal.

What are the pros and cons of taking the standard deduction?

When contemplating your tax strategy, understanding how each deduction affects your tax situation is important.

Standard deduction pros

A lot of people opt for the standard deduction on their tax returns for a handful of reasons. Firstly, it’s a quicker process, streamlining tax preparation. Additionally, the standard deduction tends to increase annually for inflation, thanks to Congress, which in turn aims to reduce taxable income in relation to increasing inflation.

The standard deduction varies depending on your filing status (single, married filing jointly, head of household) and is higher for individuals 65 or older and/or blind. Note that married couples choosing to file separately can’t take the married filing jointly standard deduction if their spouse chooses to itemize deductions; both spouses will have to

opt for the same approach—either itemizing or taking the standard deduction.

Standard deduction cons

Taking the standard deduction just because it’s easy can cause you to miss out on writing off expenses that could reduce taxable income further.

Choosing between standard and itemized deductions boils down to numbers. If your itemized deductions surpass the standard deduction, then go for it. If the standard deduction is more beneficial, take that route and save some time.

Don’t worry about knowing how to figure out whether you can claim the standard or itemized deductions. No matter what moves you made last year, TurboTax will make them count on your taxes. Whether you want to do your taxes yourself or have a TurboTax expert file for you, we’ll make sure you get every dollar you deserve and your biggest possible refund – guaranteed.

[ad_2]

Source link