[ad_1]

Throwback and throwout rules are obscure provisions of states’ taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

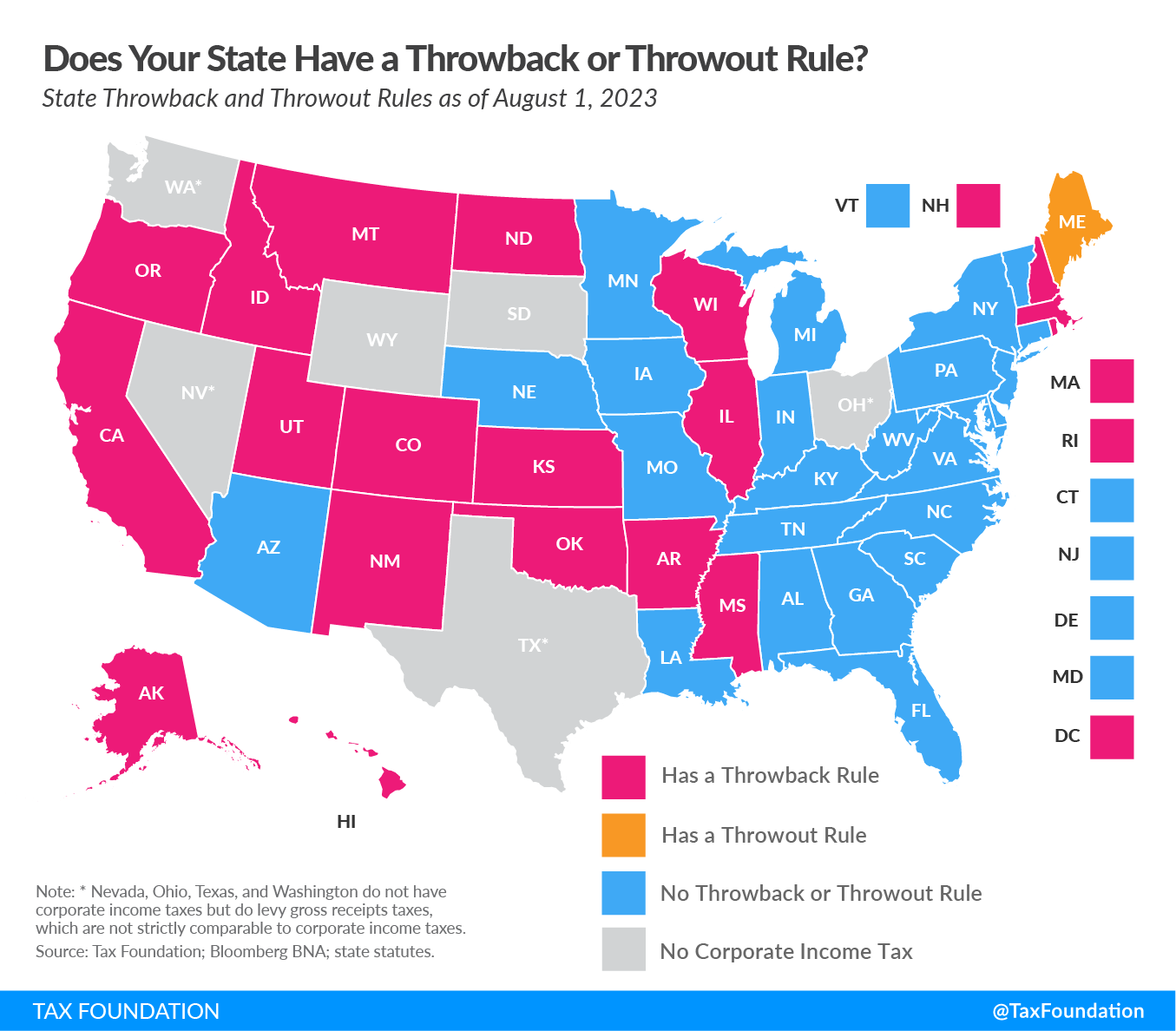

codes, but these little-known rules have real economic consequences. Fortunately, states are increasingly repealing these economically harmful rules. Since 2020, Alabama, Louisiana, Missouri, Vermont, and West Virginia have all abolished throwback or throwout rules, with Arkansas adopting a multi-year phaseout and other states—especially Oklahoma—seemingly poised to follow suit. However, 19 states and the District of Columbia still impose throwback rules, while Maine imposes a throwout rule. They should follow the lead of the five states that recently eliminated them.

Throwback and Throwout Rules: A Short Intro

There are three types of apportionment formulas states can use to determine the share of a firm’s profits subject to corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

in their state. These include an equally weighted three-factor formula (payroll, property, and sales), a three-factor formula with unequal weights (the sales factor is typically double-weighted), and a single sales factor formula. Many states have shifted to a single sales factor apportionmentApportionment is the determination of the percentage of a business’ profits subject to a given jurisdiction’s corporate income or other business taxes. U.S. states apportion business profits based on some combination of the percentage of company property, payroll, and sales located within their borders.

formula in an attempt to benefit in-state firms and export a higher tax burden to out-of-state or foreign firms. As of August 2023, 32 states use the single sales factor formula.

Sometimes, however, sales are into states with which a business lacks nexus (legal authority to tax). Throwback or throwout rules were designed in an effort to tax “nowhere income,” which emerges when businesses make sales into states where their income is not taxable (typically because these states lack jurisdiction to levy tax on a given corporation). Essentially, the idea is to throw untaxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income.

from outbound sales back into the corporate income tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates.

of the respective state. In an ideal world, this attempt would tax 100 percent of corporate income and avoid the situation when a nonnegligible share of profits is not taxed at all. However, since states are not subject to a unified apportionment formula, there may be certain situations when more than 100 percent of corporate income is actually taxed.

One practical example can demonstrate how different types of apportionment formulas combined with nontransparent throwback rules often lead to the problem of taxing more than 100 percent of corporate income. In this example (see Table 1), Firm X is located in State A and has all its property and employees in State A but sells goods to customers in States B and C as well (40 percent of its sales are in State A, 40 percent are in State B, and 20 percent are in State C). The two scenarios considered in this example differ in apportionment formulas and the usage of a throwback rule by State A.

In both scenarios, State B apportions 40 percent of Firm X’s corporate income since it uses a single sales factor formula, while State C cannot tax Firm X since the firm lacks economic nexus in the state.

In Scenario 1, State A uses a three-factor apportionment formula with equal weights of sales, payroll, and property factors and imposes a throwback rule to tax “nowhere income.” Since all employees and property of Firm X are in State A, the state taxes 67 percent of the firm’s corporate income based on these two factors. The sales factor for State A is calculated as follows: 33.3% * 40% (based on the share of sales in State A) + 33% * 20% (based on the share of “nowhere income” that comes from State C and is thrown back into State A’s sales) = 20%. In total, State A apportions 87 percent of Firm X’s corporate income. Together, States A and B apportion 127 percent of Firm X’s income, which demonstrates the detrimental nature of both three-factor formulas and throwback rules.

In Scenario 2, State A shifts to using a single sales factor formula with no throwback rule. As a result, State A’s apportionment share drops from 87 percent to 40 percent of Firm X’s corporate income. Together, States A and B now apportion 80 percent of Firm X’s income. Clearly, Scenario 2 is more favorable to businesses and, unlike Scenario 1, incentivizes Firm X to stay in State A instead of making expensive relocation decisions caused by the overtaxing of its corporate income in Scenario 1.

Repealing Throwback and Throwout Rules: A Recent Trend

As of August 1, 2023, 19 states and the District of Columbia have throwback rules in their tax codes and one state (Maine) has a throwout rule, while South Dakota and Wyoming do not levy either a corporate income tax or a gross receipts taxA gross receipts tax is a tax applied to a company’s gross sales, without deductions for a firm’s business expenses, like costs of goods sold and compensation. Unlike a sales tax, a gross receipts tax is assessed on businesses and apply to business-to-business transactions in addition to final consumer purchases, leading to tax pyramiding.

(Nevada, Ohio, Texas, and Washington levy gross receipt taxes instead of taxing corporate income). The list of states that impose throwback or throwout rules has gotten much shorter: since the publication of our comprehensive primer on this topic in 2019, five states have repealed these rules: Alabama, Louisiana, Missouri, Vermont, and West Virginia. Arkansas will begin phasing out its throwback rule in 2024.

On June 1, 2018, shortly before his resignation, Missouri Governor Eric Greitens (R) signed into law Senate Bill 884, which introduced a single sales factor apportionment formula without a throwback or throwout rule for tax years beginning on January 1, 2020.

On February 12, 2021, Alabama Governor Kay Ivey (R) signed into law HB 170, which introduced the Alabama Business Tax Competitiveness Act. This act replaced the state’s three-factor apportionment formula with a single sales factor formula and repealed the throwback rule.

On April 9, 2021, West Virginia Governor Jim Justice (R) signed into law HB 2026, which repealed the throwout rule and also changed the apportionment formula to a single sales factor formula for tax years beginning on January 1, 2022.

On May 31, 2022, Vermont Governor Phil Scott (R) signed into law SB 53, which changed several provisions related to the state’s corporate income tax, including the repeal of the throwback rule and the introduction of a single sales factor apportionment formula.

On June 27, 2023, Louisiana Governor John Bel Edwards (D) signed into law HB 631, which adjusted the state’s apportionment formula and repealed the throwout rule.

All these states made their corporate income tax codes simpler and more neutral by eliminating negative incentives for businesses to migrate from the state due to potential overtaxing of their corporate income. As a result, most of these states have become more competitive on the corporate income tax component of the State Business Tax Climate Index. From 2020 to 2023, Alabama improved from 23rd to 18th, Louisiana from 36th to 32nd, and Vermont from 43rd to 41st, while Missouri and West Virginia maintained their already competitive 3rd and 16th places, respectively.

For many corporations, throwback rules have little impact—but for some, particularly smaller manufacturers, the impact can be substantial. It can yield taxation at multiples of the state’s rate on the share of income actually derived from the taxing state and can be enough to drive a business out of state. In fact, the literature on throwback rules suggests that these provisions are one of the few that actually lose revenue over time. This is because affected businesses locate operations in other states to avoid the tax, depriving the state of revenue it would have generated had operations remained in-state.

Policy Implications for States with Throwback and Throwout Rules

As more states move away from throwback or throwout rules, those that still impose these rules will become less attractive for businesses, which are incentivized to relocate their sales activities to non-throwback states. This may potentially cause the outmigration of businesses and offset any revenue gains from taxing “nowhere income.” The repeal of harmful throwback or throwout rules is an example of simple and neutral pro-growth tax policy and an important recent trend in state corporate income taxation. This positive trend should—and likely will—continue.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share

[ad_2]

Source link