[ad_1]

As the Office for National Statistics has reported this morning:

- The Consumer Prices Index (CPI) rose by 4.0% in the 12 months to December 2023, up from 3.9% in November, and the first time the rate has increased since February 2023.

- On a monthly basis, CPI rose by 0.4% in December 2023, the same rate as in December 2022.

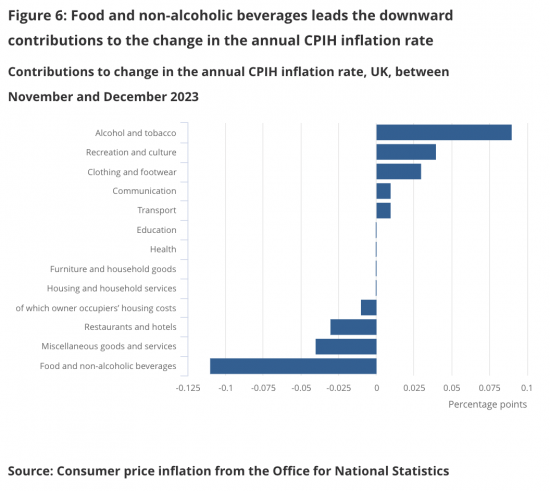

- The largest upward contribution to the monthly change in both CPIH and CPI annual rates came from alcohol and tobacco while the largest downward contribution came from food and non-alcoholic beverages.

- Core CPI (excluding energy, food, alcohol and tobacco) rose by 5.1% in the 12 months to December 2023, the same rate as in November; the CPI goods annual rate slowed from 2.0% to 1.9%, while the CPI services annual rate increased from 6.3% to 6.4%.

Let’s put this in context. The main contributors to inflation in the month were:

The rise in tobacco prices is still related to a change in the law deliberately pushing prices up. Everything else nets out to zero. And no one expected another significant fall in inflation until the energy price cap falls in a couple of months’ time.

The media will be all over this saying the battle on inflation has not been won as yet and that catch up wage rises are threatening a wagwe price spiral. All of that is nonsense. By mid-year inflation will be near 2%. That will be hard to avoid now. Eberything else in the media omn this issue is just fodder to let the Bank of England keep interest rates high.

[ad_2]

Source link