[ad_1]

The EU Tax Observatory has a new report on tax evasion out this morning.

Or, to be precise, they have a new report on tax evasion by the super-wealthy out this morning because that is what the EU has funded them to look at.

In the Executive Summary, they note:

It is very odd that they ignore country-by-country reporting given no one else does. It is true that if you are considering evasion rather than avoidance country-by-country reporting is not a big deal as it was almost wholly focussed on avoidance, but so too is the global minimum tax rate for multinational corporations, so this makes little sense.

However, as they then note:

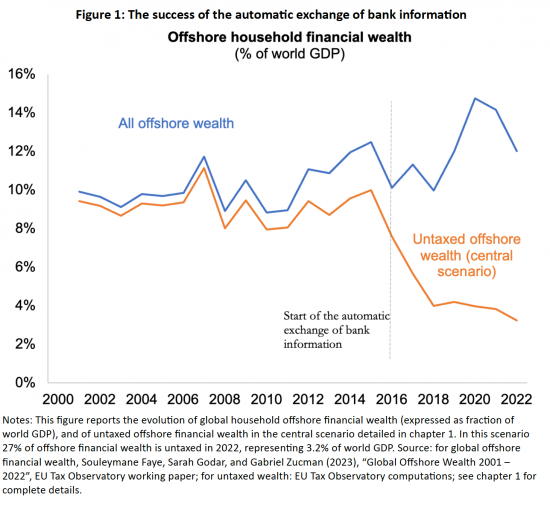

The decline in offshore tax evasion is what I would expect. Quite simply, the campaign for automatic information exchange from tax havens, which I and a few others led from 2005 onwards, worked. It took a lot of effort for about a decade but the results are now seen.

The fact that the global minimum tax rate is not working is now down, in no small part, to the active opposition to it from the current leadership of the tax justice movement who, for their own political reasons (mainly aimed at undermining the Organisation for Economic Cooperation and Development) have done all they can to discredit its actions even though the OECD is the only organisation in the world with a chance on delivering on this issue. I am baffled as to why these tax justice campaigners still have any funders left.

Third, there is still tax evasion by the ultra-wealthy.

On this last issue, they note that overall the offshore tax problem has fallen, dramatically:

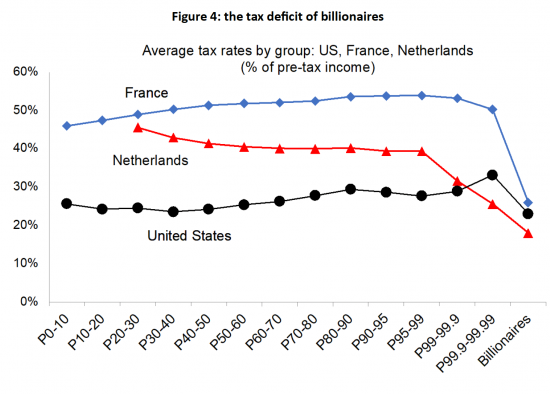

But they add that the problem of taxing billionaires remains:

They argue that this trend is because states still allow the wealthy to hold their assets in personal companies, and that massively reduces their tax rates.

I agree, entirely. This is an issue. Tackling it is a driving force behind the Taxing Wealth Report 2024.

There the similarity ends. I argue that the answer is to impose better taxes on the income from wealth nationally. I have already demonstrated that if there is a £170bn tax shortfall in the UK, as I think likely, more than £100 billion of it can be recovered by actions in the UK targeted at the wealthy. I have more suggestions to make as yet.

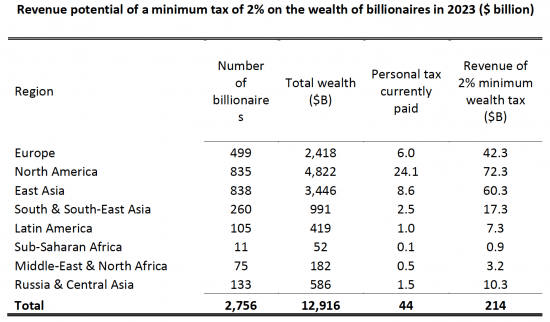

The EU Tax Observatory do not agree. They suggest an international wealth tax, based on the work of Thomas Piketty. They suggest that the revenue to be raised might be:

Three things are worth saying.

The first is that there is no hope of such a tax happening. The international cooperation required to deliver it does not exist, and will not exist. I would like to say otherwise, but I just cannot see it. In an era where tax competition is still the norm the cultural change required for this to happen is not present in most states, let alone between them which is a much further demand to make.

Second, as I have long argued, wealth taxes are nigh on impossible to collect because whilst global and national estimates of aggregate wealth can be prepared in micro detail, every single wealthy person will dispute the value placed on almost every asset that they own, from a work of art, to a racehorse, to land, to jewellery, to the value of the shares in a private company and trying to raise any tax at all will, as a result, be a logistical nightmare that will tie up the court systems of countries for years. This is the problem with all tax proposals by those who have never worked in tax.

Third, there is simply a better way to do this, as I am showing with the Taxing Wealth Report 2024. In the UK alone, I can suggest ways to raise more than half the global total that the EU Observatory is suggesting. In that case, if my methodology – which is based on deliverable tax changes – was extended, then very much more could be raised – including from the super wealthy whose wealth holdings can be shattered open simply by deeming the companies that they own to be transparent for tax purposes under what are called ‘close company‘ rules, which I will write about in the Taxing Wealth Report 2024 as soon as I can get the time to do so.

In summary, this report is useful, but the trajectory of thinking on how to solve this problem that it proposes is, I suggest, wrong. The problem of tax abuse by the wealthy has to be solved locally, not least because that is the place where the incentive to act will exist, if it does at all.

[ad_2]

Source link