[ad_1]

I have spent much of this afternoon, a) talking to journalists and b) trying to work out how the Budget adds up.

The first task was relatively easy. The second was less so.

In part, the great cost saving in the Budget is on interest: it has been assumed that the cost of government borrowing will fall quite quickly to 3% rather than the 4% assumed last November. That finds £10 billion.

But, that was not enough, so I went on a hunt for the rest that explained how Hunt was going to give tax away. I finally got to Table A5 of the Annex to the Office for Budget Responsibility’s Economic and Fiscal Outlook publication that supports the Budget data, and there I smelt a rat.

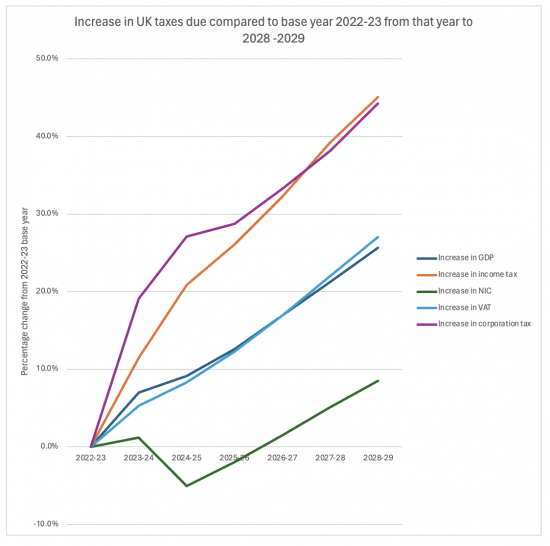

I prepared the following chart by noting n0minal GDP from table A3 of that annex for 2022-23 to 2028-29 and then noting data from table A5 on income tax, national insurance, VAT and corporation tax over the same years.

Then I calculated GDP and tax receipts for each year as a ratio of the 2022-23 figure to show growth in them, and then plotted this to get this chart:

The two blue lines in the centre that almost match each other are GAP growth and VAT, which unsurprisingly match each other almost exactly.

National insurance declines markedly: Hunt is pretending that he really will get rid of this tax.

But then note what happens with both income tax and corporation tax: both rise at rates well over anything that can be justified by the growth in GDP.

Corporation tax is a small tax; silly forecasts can be made for it, and this one is absurd: profitability is not going to grow at that rate.

But, income tax is what really matters. The forecast increase is utterly disproportionate. The growth in tax owing each year is at a rate almost double the rate in the growth of GDP.

To put this in context, income tax shown to be due in 2028/29 is £48 billion more than it would be if it grew at the rate of GDP growth.

In other words, the actual rates of income tax increase we will all actually be suffering because of fiscal drag over the next few years are going to be very high indeed – and that is how Hunt is supposedly balancing its books.

In that case, the real question to ask is, what is Labour going to do about this? We have a tax time bomb waiting to explode in the UK. Are they going to let it go off?

[ad_2]

Source link