[ad_1]

An, as yet, unpublished part of the Taxing Wealth Report is on the governance of HM Revenue & Customs, which I have long felt to be dire, for reasons that I will explain.

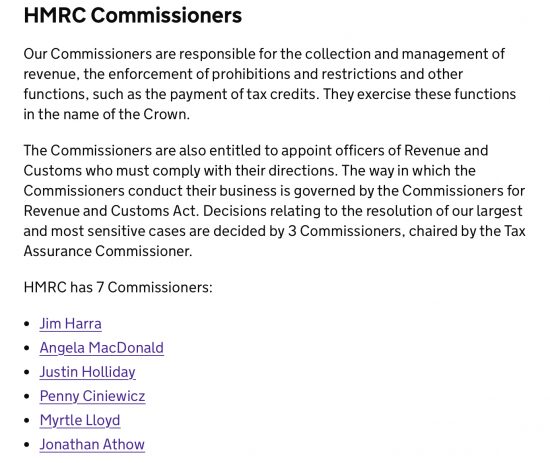

I was looking at this issue yesterday, and noted this:

Try as I might, I can only spot six names in that list. The website is, however, quite sure that HMRC has seven commissioners.

Try as I might, I can only spot six names in that list. The website is, however, quite sure that HMRC has seven commissioners.

So, I thought I might suggest some questions of the sort a tax inspector might raise during a tax investigation resulting from this obvious misstatement:

- You appear to be understating your Commissioners by about 14%, HMRC. Why is that?

- What else have you got wrong if you cannot get this right, HMRC?

- Might we assume that if this number is 14% understated your income is as well?

- If you wish to blame a software updating error shall we still assume everything is understated by 14%? After all, that must follow, mustn’t it?

- You have clearly been careless in the presentation of your data. Shall we agree a 30% penalty is due on all resulting misstatements is appropriate, even if unrelated to this error?

- There will, of course, be an interest rate charge.

- Because we found your mistake the cost of this tax investigation will not be tax deductible, even if your error was innocent.

- Oh, and because of our staffing shortages we apologise fur changing the personnel dealing with this matter three times in two years, for losing your file and often not answering your correspondence for months, thereby stretching out the agony of this episode for you, but no, there is no compensation for that, including for the additional costs you incurred.

You don’t believe me? You really should.

And what I would still really like to know is, who is the missing tax commissioner who so obviously ticked the box saying ‘no publicity’ when applying for the job?

[ad_2]

Source link