[ad_1]

Accounting and finance professionals in the U.S. are leaving their jobs at a significant rate, with millennials and Generation Z leading the exodus, according to a new report from the Institute of Management Accountants (IMA) and staffing firm Robert Half.

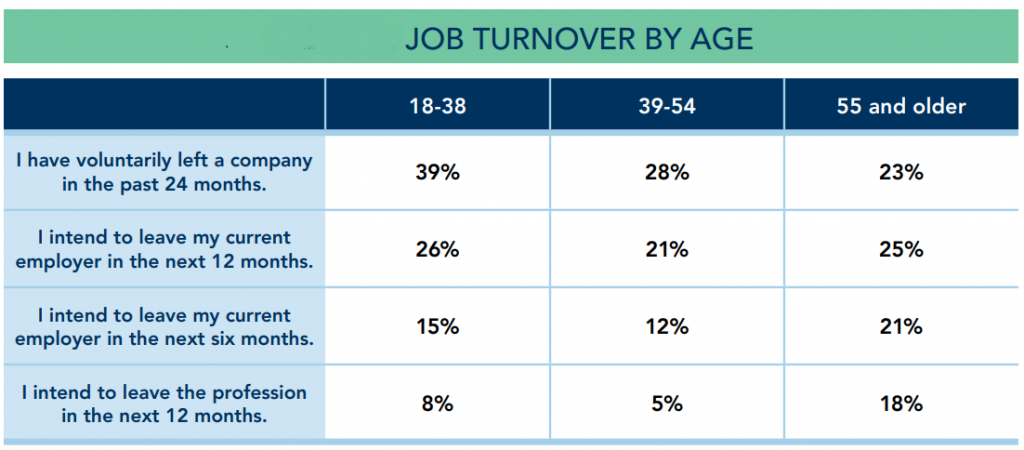

The report, Talent Retention in the U.S. Accounting and Finance Profession, based on a survey of 1,236 current and former accounting and finance professionals and academics in the U.S., reveals that professionals ages 18 to 36 experienced the highest turnover (39%) over the past 24 months and are most likely (26%) to leave their current accounting or finance job within the next year. In addition, 8% of those employees are considering leaving the profession altogether in the next 12 months. Eighteen percent of accounting and finance professionals ages 55 and older are planning to leave their job in the next 12 months mainly due to retirement, according to the report.

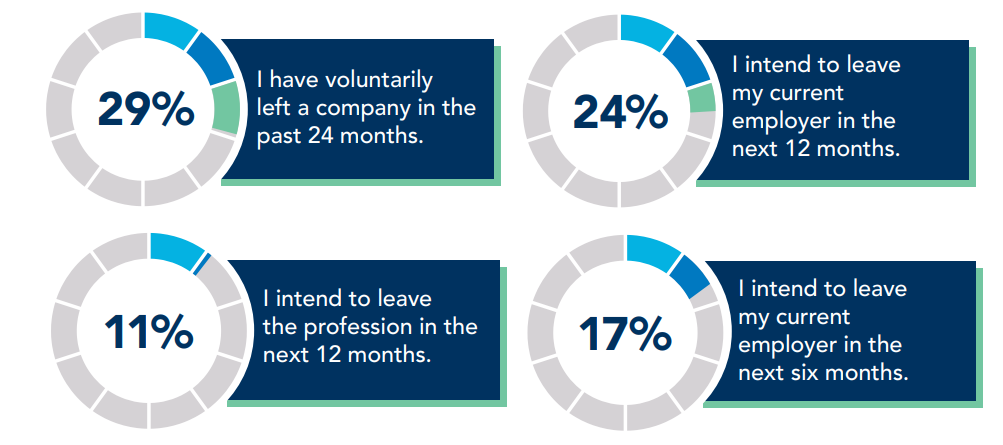

Overall, nearly one-third (29%) of respondents said they have left a company in the past two years, the study found. Additionally, nearly a quarter (24%) of accounting and finance professionals are expecting to leave their current firm within the next year, with the majority—71% of those expecting to leave in the next 12 months—intending to leave within the next six months. More than one in 10 accountants in the U.S. intend to leave the profession over the next 12 months.

“The accounting and finance profession is facing significant barriers to retaining talent, but this study provides us with insights into key factors contributing to the job turnover currently impacting the profession,” Dr. Susie Duong, senior director of research and thought leadership at IMA and co-author of the study, said in a press release. “It’s essential that organizations acknowledge the reasons for which professionals are leaving at a high rate and implement effective strategies that can change the trajectory of the talent pipeline.”

5 reasons why they are leaving

So, why are accounting and finance professionals looking for greener pastures?

1. Job satisfaction … or the lack thereof: The majority of accounting and finance professionals surveyed said they are satisfied with the work they are required to perform (87.1%), their co-workers (86.5%), and their supervisor (78.4%). Yet, there are sizable variations between those who intended to leave their job and those who intended to stay, the report says.

Nearly 30% of those who intend to leave their current employer in the next 12 months expressed dissatisfaction with their work and co-workers. Moreover, half of those who expect to leave their current employer in the next 12 months said they were not satisfied with their supervisor, while only 12% of those who intended to stay expressed the same concern.

2. Limited career advancement: While nearly a quarter of accounting and finance professionals (24%) intending to stay with their current employer expressed concerns about advancing within their organization, the percentages are significantly higher for those who believe they will leave their current employer in the next 12 months (74%) or leave the profession entirely (75%). More than 80% of professionals intending to leave their employer in the next six months did not expect to advance in their current firms.

3. Lack of work flexibility: Approximately one-third of those who planned to leave their employer or the profession reported a lack of flexibility in determining where to work, with only 17% of those intending to stay sharing this view. With respect to flexibility in determining how work can be performed, approximately one-fifth to one-quarter of those who intend to leave indicated inflexibility in this regard.

4. Not engaged with work: A large percentage of accounting and finance professionals who are planning to leave their employer (57%) or the profession (25%) reported being disengaged with work or the workplace, according to the report.

The main reasons employees feel disengaged from work include:

- My contributions are not adequately valued in my organization.

- I do not have enough opportunities to grow and develop.

- I was overworked for too long and chose to disengage.

- I do not feel that my leadership cares about my well-being.

5. No sense of belonging: More than 40% of those who intend to leave in the next six or 12 months highlighted the absence of a strong sense of belonging in their firm, while only 10% of those intending to stay shared the same perspective. Similarly, a significantly higher percentage of those who expect to leave their current role—46% within the next 12 months, 47% within the next six months, and 36% who intend to leave the profession entirely—say they do not feel valued, respected, or supported within their organization, compared to 12% who intend to stay in their current job.

5 strategies for retaining talent

Successful strategies for talent retention are often based on a comprehensive approach that combines competitive compensation and benefits with policies and initiatives such as fostering an inclusive and supportive workplace culture, respecting employees and recognizing their performance, providing career growth and development opportunities, and promoting work-life balance through flexible work arrangements, IMA and Robert Half said in their report.

1. Offer competitive compensation and benefits: Seventy-nine percent of accounting and finance professionals intending to stay with their employer reported receiving outstanding “perks” on the job, while 80% agreed that they were well-compensated, and 83% were satisfied with their benefits.

Employers need to ensure employees are not only paid at or above market rates but that they also are offered performance bonuses, comprehensive benefits (such as health insurance and retirement benefits), and other perks (such as tuition reimbursement, a stipend for home offices, and a flexible time-off policy).

2. Foster a supportive and inclusive firm culture: A majority of respondents who intend to stay with their current employer emphasized the importance of fostering a supportive and inclusive corporate culture and work environment. In particular, 95% say they believe they are a good match for their organization, and 92% felt they are a good fit with the culture in their firm.

According to accounting and finance professionals surveyed, an environment that embraces open communication; diversity, equity, and inclusion (DE&I); and employee engagement is more likely to retain top talent.

3. Respect and recognize employees: The importance of respecting employees and recognizing their performance appropriately was highlighted by many accounting and finance professionals. This includes valuing employee contributions and performance, cultivating a culture of respect and appreciation, giving employees a voice by involving them in decision making, and providing constructive feedback.

4. Provide career growth and development opportunities: Accounting and finance professionals emphasized strong demand for professional development and growth opportunities to achieve their career goals and aspirations. To retain talent and achieve sustainable organizational growth, employers should invest in employee development through continuous education, personalized career development planning, and other upskilling initiatives.

5. Provide flexibility and work-life balance: Firms can support employee well-being by creating an environment that promotes better work-life balance. This can be achieved by allowing flexible working hours, offering hybrid or remote work arrangements when possible, encouraging autonomy in determining how work is performed where appropriate, and investing in initiatives focusing on physical and mental health as well as the overall wellness of employees.

“Organizations in every industry need to prioritize retention, but it’s especially important for leaders in accounting and finance who are faced with challenges related to talent shortages,” said Steve Saah, executive director of finance and accounting permanent placement at Robert Half. “It can’t be a reactive strategy—organizations should have a plan that prioritizes attracting talent and creating a positive lifecycle that leads to less turnover.”

[ad_2]

Source link